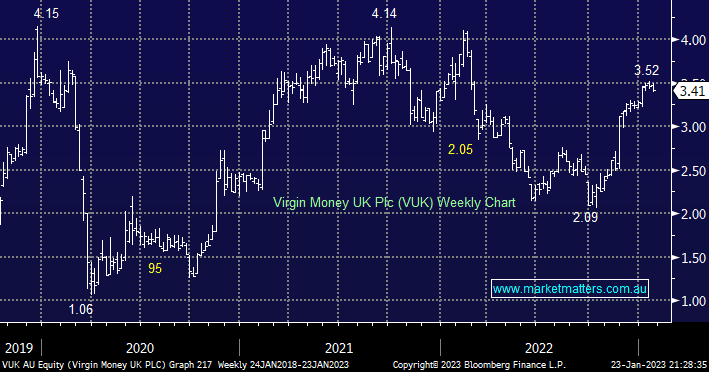

VUK has soared over 65% over recent months but it’s starting to feel exhausted around $3.50 i.e. a rest is potentially needed but we expect buying to emerge into weakness after November’s strong result. VUK remains one of the cheapest global banks trading ~0.5x price to book, for context CBA is the most expensive trading above 2.5x.

- We like VUK into pullbacks, hence it remains in our Hitlist, The stock’s forecast yield over the next 12 months is now in excess of 5% which lends weight to our view that investors will emerge into dips.