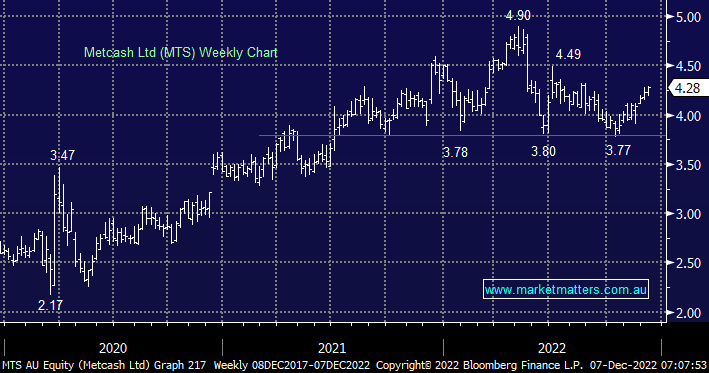

We got 1H23 results from the grocery wholesaler and growing hardware operative earlier this week and they were solid in all key metrics, this performance has driven the share price 8% higher over the measured period. While we originally bought MTS at $3.50 and collected some nice dividends along the way, we think MTS will continue to be a slow burn on the upside with our eventual target sitting at $5.00.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM remains moderately bullish MTS targeting $5

Add To Hit List

In these Portfolios

Related Q&A

AFR’s comments re Metcash

Metcash (MTS)

What would be your entry price for Metcash?

Metcash in the Active Growth Portfolio

Metcash SPP at 8% discount – is it worth it?

Does MM still like Metcash (MTS) after recent falls?

Could you update your views on ABP & MTS

MM’s current views on MTS and semiconductors please

Some thoughts on Metcash (MTS)

Is Metcash (MTS) a buy?

What are GARY stocks?

Understanding the Metcash buy-back

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.