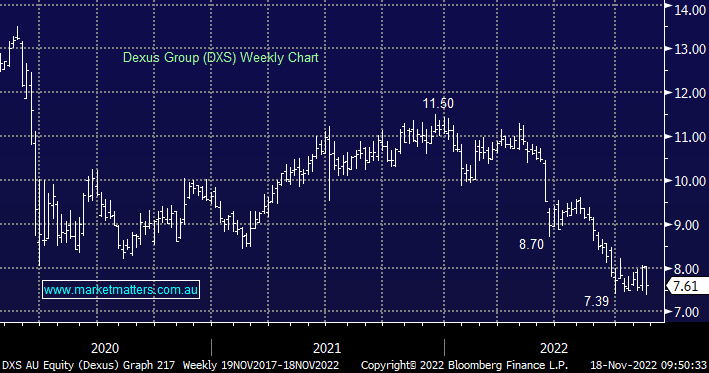

What are MM’s updated thoughts on Dexus (DXS)?

This part of my question was missed last week so I am just following up on it :) Hi - you have written about DXS previously, both about owing it in the past and potentially buying it again. Do you still like it, particularly at current levels, and if so, why? Also, if so, what would your target range be to begin accumulating? More recently, the DXS share price fell sharply, presumably in relation one or both of the recent announcements about an offer of guaranteed exchangeable notes and concurrent repurchase of existing notes; and an update on the Collimate Capital acquisition. What, in your view, was the reason for this reaction and does this influence your general view on DXS at all? Thanks Darren