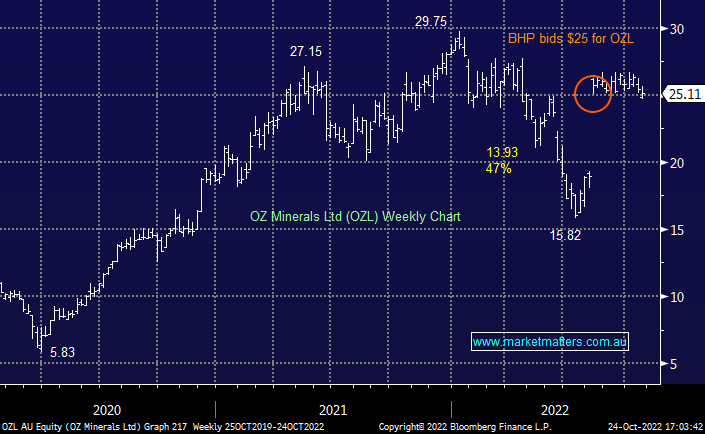

OZL -1.18%: Was trading back below the BHP bid price today following a weaker-than-expected production report – another miner struggling with multiple pressures impacting volumes and costs, although they did maintain full-year guidance. Here’s Peter O’Connors comment… CY22 has been a more challenging year in terms of delivery to guidance than any prior year under the current team (since start 2015). Worth noting though that near term blemishes don’t change long term value creation opportunities or indeed valuation. To that end we note that the BHP CEO suggested a the FT Mining Summit (over the weekend) that “OZL was a nice to have, not a must-have.” Interesting and a sentiment we would concur with. But the company has nonetheless lobbed a A$25/share cash bid on OZL which the BHP CEO deemed … “quite attractive.” Note he did not say very attractive or exceptionally attractive or fully priced or last and final. The door has not closed yet, in our opinion, on BHP’s advance(s).

We expect that the next move will see a bump in bid terms to get OZL engaged and give BHP due diligence access. We maintain $30/sh target price.