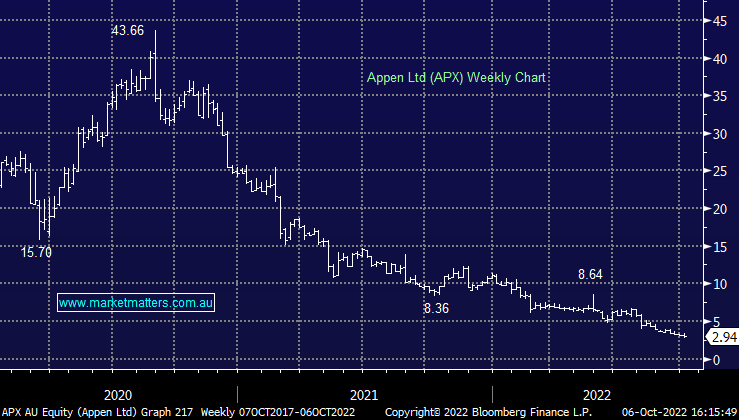

APX -11.71%: the digital marketing AI company fell below $3/sh for the first time since 2017 today following a downgrade to guidance. Just 6 weeks ago the company was talking to a stronger second half, though revenue was still expected to fall short of FY21 levels. Today, the company said conditions had failed to improve as expected and further uncertainty remains into the end of the year, providing guidance of $US375-395m for revenue, ~14% below FY21 and 5% below consensus. Margins have also been impacted with a lower portion of sales coming from high-margin work. It’s been a challenging period for Appen with EBITDA now expected to fall 80% in a year and digital ad revenue going backwards.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM has no interest in APX

Add To Hit List

Related Q&A

Appen Ltd (APX)

McMillan Shakespeare Ltd (MMS)

NEC and APX

Appen and Nuix

MCMILLAN SHAKESPEARE LIMITED

Appen Ltd (APX)

Thoughts on MMS?

Pullback on MMS and SIQ

Thoughts on Appen (APX) and CSR

Thoughts on mff

MMS view going forward

Sigma and Chemist Warehouse merger

Any thoughts on Meteoric Resources (MEI)?

Thoughts on MMS and SIQ share price movements

MM call to ‘Cut Losers’ like MFG, KGN, APX

Does MM prefer MMS or SIQ?

Updated view on few battered up stocks?

Appen (APX)

New CBA Hybrid + APX & CSL

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.