Hi Jeff,

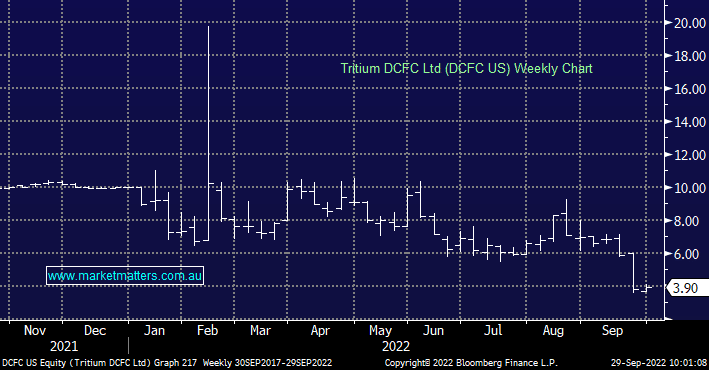

We like Tritium (DCFC US) at MM, its a company / theme that we wrote about last April, but while its a great story as a non-profitable tech company its not very popular at present which has seen its shares fall by over 50% since mid-August i.e. its clearly a speculative high beta play.

The business was actually started in Brisbane more than 20-years ago and last year they listed on the Nasdaq via a Special Purpose Acquisition Company (SPAC), valuing the stock at $1.2bn. The company has already sold 76,000 electric chargers across 41 different countries and currently now has a more muted market cap of US$0.6bn, importantly its not for the faint hearted as we’ve seen by share price moves already through 2022.

We believe the companies definitely operating in a great space and if / when they can become profitable it could advance significantly from todays sub $US4 area.

As for locally traded IPD Group (IPG) we like this $182mn Sydney based electronics business but after doubling through 2022 we would like the stock 5-10% lower i.e. under $2. Insiders (Directors) own over 50% of the company and they’re still buying which adds a tick to MM’s bullish view.