Hi Jacky,

A reminder that we provide general as apposed to personal advice and we can only really evaluate the stocks at todays level post their results.

DGL Ltd (DGL): We covered in another question today ultimately saying “We are not close followers of this $425mn business but value does look interesting ~$1.50 with the stock now trading on an Est P/E of sub 12x for 2023.” A bounce from oversold levels is likely however it’s not one for us.

Raiz Invest (RZ1): Unfortunately this $55mn Sydney based financial, services business has fallen over 65% this year and is making fresh post Covid lows into the weekend, we simply see no reason to buy the stock.

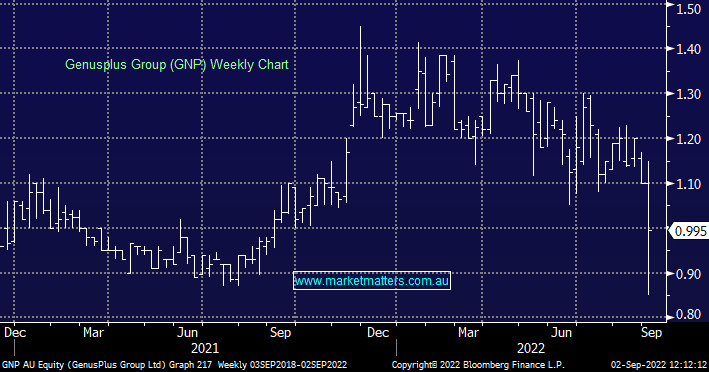

Genusplus (GNP): This $168mn power & telecom solutions business fell ~20% after its report this week which on the surface looked ok:

- Revenue of $451 million – up 42% on PCP of $318 million, cash inflow from Operations of $11.5 million, earnings per share of 8.4 cents per share and a dividend declared of 1.8 cents per share fully franked

Combined with a strong orderbook of $488 million over FY2023 of $304 million and FY2024 of $184 million we believe this stock looks ok below $1 for the brave.