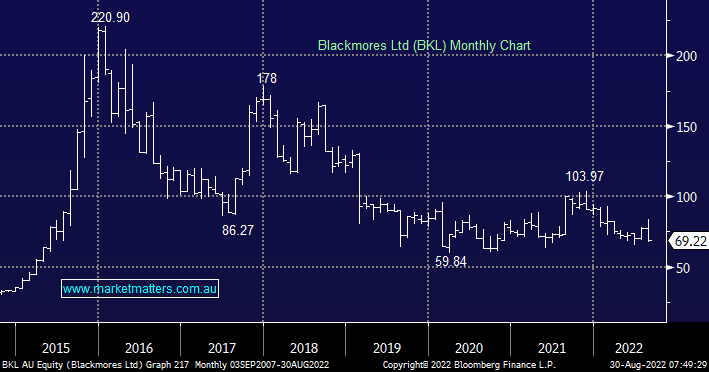

Vitamins and supplements business BKL generate 22% of its revenue from China but this is one market where rapidly evolving competition is hurting BKL’s sales and margins. The stock’s again been under pressure since delivering its FY 2022 results earlier in the month and although on the surface the numbers looked ok the stock feels expensive to us trading on a P/E of 32.3x for 2023, given single-digit revenue growth and the competitive landscape they now find themselves in.

- We’ve avoided BKL for many years and still see no reason to 2nd guess where the current decline will end.