Does MM like Betmakers Technology (BET)?

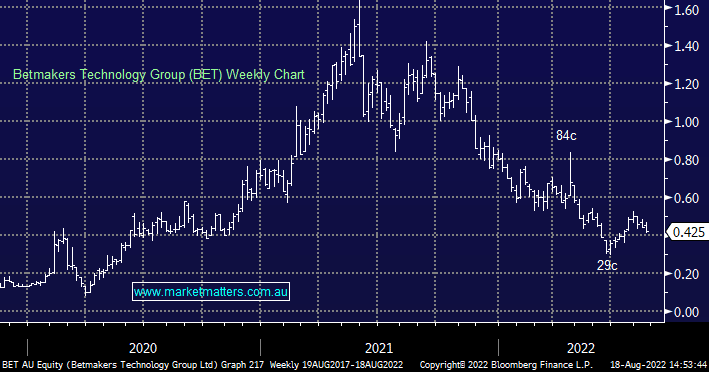

Thanks a lot for your good advice. Keep up with your good work. Thanks for taking my question! The share price of BET has dropped from the year high of $1.42 to the current price of $0.445 (close on 12/Aug) In the last Quarterly report, BET reported cash receipts came to $26.2 million last quarter, marking a 194% improvement; and its unaudited financial year 2022 revenue has soared to $91.6 million up from around $19.5 million in financial year 2021. BET also announced recently Share Buyback for up to 10% of outstanding shares. I think that the market has bottomed out and is this the right time to start nibbling at BET? Thanks!!!