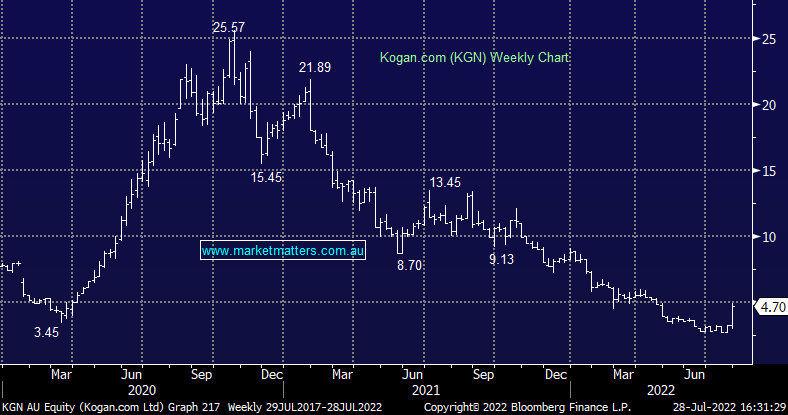

KGN +50.16%: shares in eCommerce business Kogan.com surged to 3-month highs today on the back of better-than-expected performance in the business. Sales for FY22 are expected to come in marginally above the prior year, beating out expectations of a fall from the COVID-supported growth of FY21. While sales are up, EBTIDA is expected to fall to $19.1m, which is still a small beat to consensus. Impressively they have managed to reduce inventory levels from $228m down to $161m, which includes $22m already in transit. Warehousing costs had been an issue for Kogan with inventories blowing out requiring expensive overflow capacity. Importantly it appears stock has been moved without the need for significant discounting.

scroll

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

A better than feared sales update from KGN

Add To Hit List

Related Q&A

What stocks would we top up here?

MM views on Qantas (QAN) & Kogan (KGN)

Our view on 3 online retailers

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.