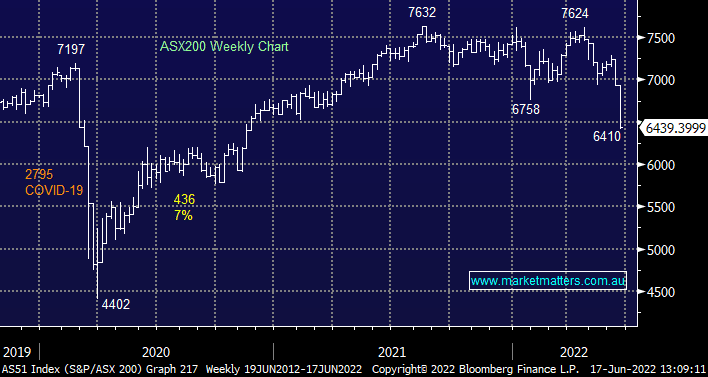

Buying strategy for 15% dip since mid April

Hi James. MM has been advocating a strategy of selling into strength rather than buying the dips for a few months which is understandable with 1% cash position in the Growth portfolio. Could you pass some comments/strategies/tips for those that are perhaps sitting on higher cash levels given the market has dropped around 15% since mid April. Thanks.