Thoughts on the Banks & CXL

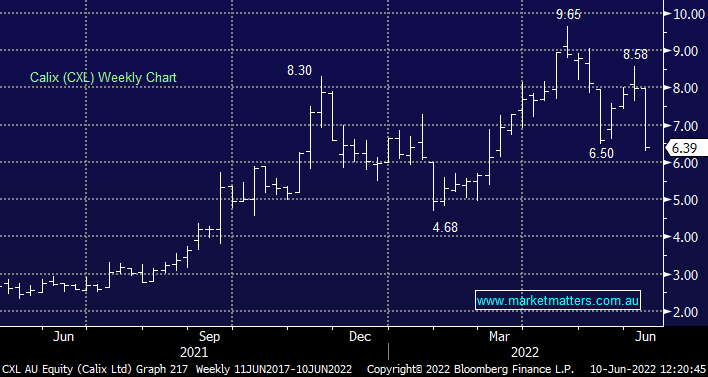

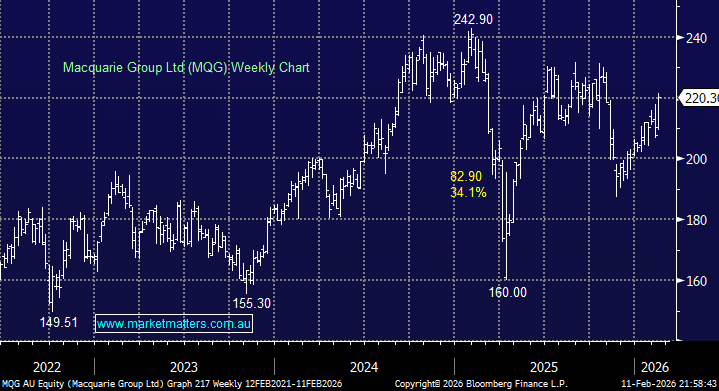

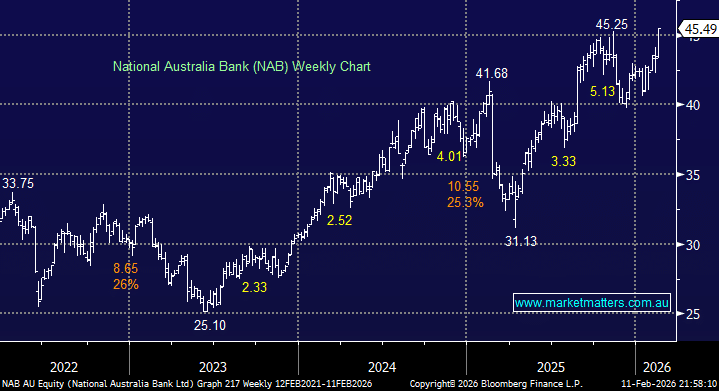

Hi James & Team I have read your views on the Banking sector - " MM is happy to hold banks in our Growth and Income Portfolios but we are comfortable being underweight, another 5-10% downside driven by the current negative sentiment would start to improve the appeal of the sector overall." If you are a long-term holder of the Banks more towards being overweight - And have been slow to react. Do you ride this out until the negative sentiment turns more positive? Do you see the current price action as overdone? CXL - The one that got away!! Never pushed the buy button. Calix has just dropped below $7 - Is this a buying opportunity? regards Debbie