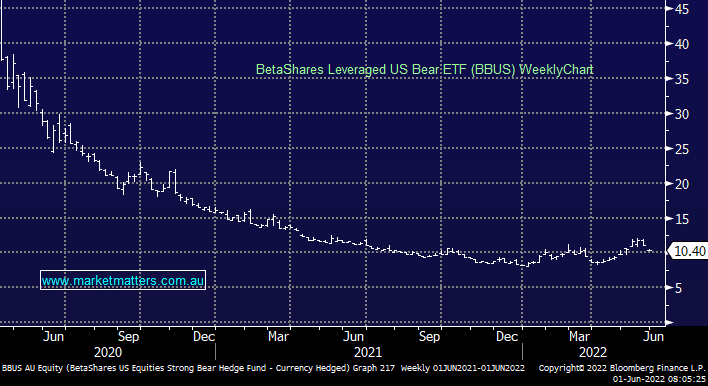

At some stage in 2022 we anticipate taking a bearish equities position via the ASX traded BBUS ETF – the locally traded fund has an inverse correlation to the S&P 500, is easily accessible on the ASX and importantly US Futures regularly trade at their extremes in their late market i.e. when the ASX is open and trading. There are a couple of points to understand with this ETF:

- It’s leveraged hence a 1% drop in the S&P 500 should deliver a 2-2.75% rally in the BBUS and vice versa.

- The management costs are 1.38% pa hence if nothing happens purchasers will slowly lose money.