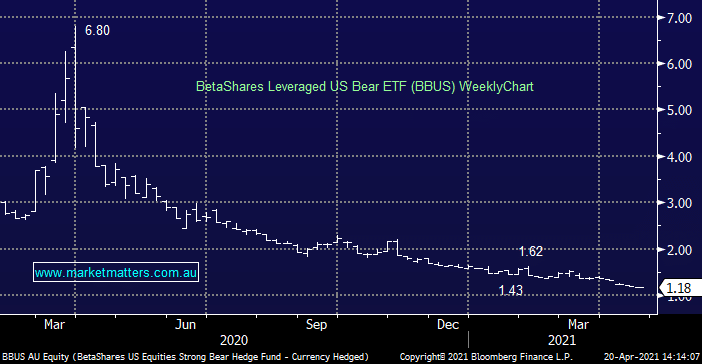

BetaShares Leveraged US Bear ETF (BBUS)

Hi James, I have found the new format very helpful thank you. (It would be great if I could just refresh the page with the last report and the latest pops up.) Can you please comment on ETF BBUS and if it is a suitable ASX substitute for the VIX? Is there a better ASX sub? Also I found great value in the webinar with the Shaw commodity expert (small, med and big stocks) you held last year and was hoping that there could be an update webinar again soon please. Cheers, Jill