Hi Don,

The last part of your question first, yes, moving money from shares to hybrids reduces risk. A Hybrid is a lower risk/lower return security than shares.

In our income portfolio, we intend to stay long bank shares into the back end of April and assuming the market has rallied further, we plan to reduce equity exposure (probably bank equity) and increase fixed income / hybrid exposure by 5-10%.

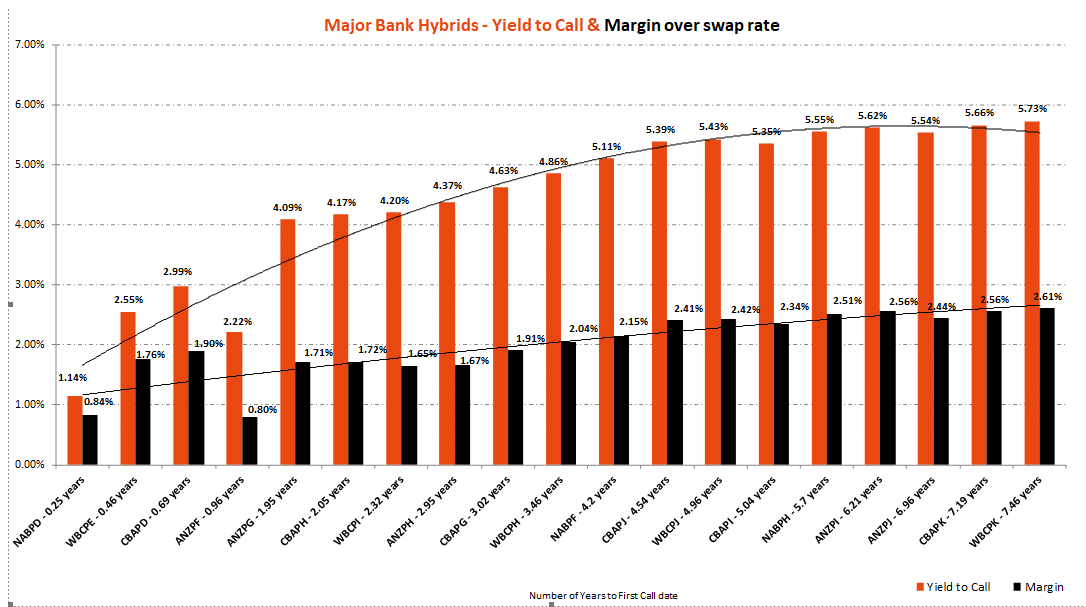

Generally the new issues in the bank hybrid space are offering best value – there should be a couple coming up, giving investors a ~0.20% uplift versus the listed peers. In terms of existing listed securities, the CBAPJ looks attractive paying 5.39% yield to first call for 4.5 years, ditto for the WBCPJ & the NABPB, slightly higher but slightly longer.