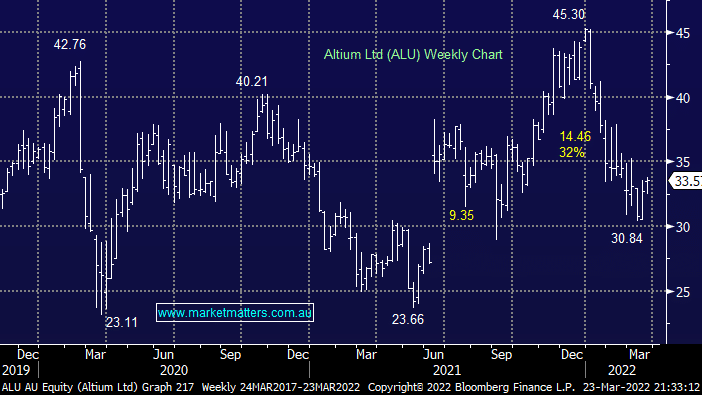

Following its sobering 32% fall ALU like much of the IT sector has started to shrug off rising bond yields, a very encouraging short-term signal for the recently unloved growth sector. We are looking for an ongoing bounce which makes sense when we consider fund managers exposure to tech is at its lowest level in 16-years.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Close

Close

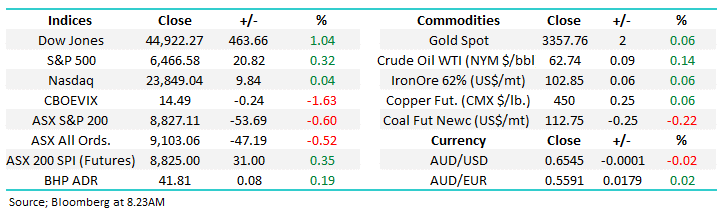

Thursday 14th August – Dow up +463pts, SPI up +31pts

Thursday 14th August – Dow up +463pts, SPI up +31pts

Close

Close

MM is looking for 10-20% upside from ALU

Add To Hit List

Related Q&A

Is Wistech (WTC) a Hitlist candidate?

Best way to play the Tech stock rally

Does MM prefer HUB24 or Altium?

What’s MM’s favourite 5 stocks for short term bull run?

Thoughts on ALU, MNS & IMU?

MM’s thoughts on ALU and TMH?

Does MM like Australian technology companies?

ALU, CDA, & 3 US-listed stocks BNTX, ZM, GOOS

Thoughts on ALU & APT

Altium smells fishy

MM view on ALU

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 14th August – Dow up +463pts, SPI up +31pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.