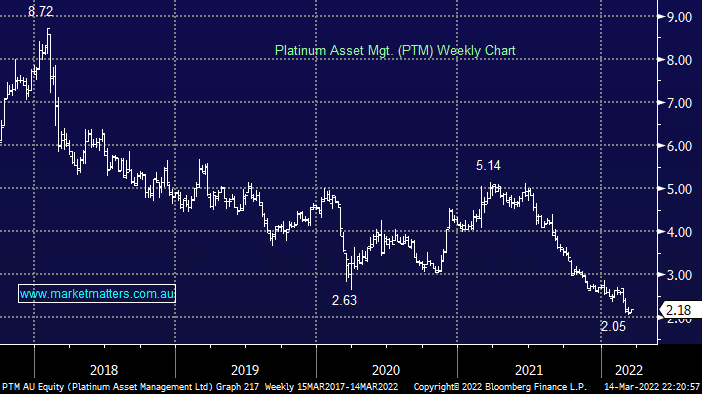

PTM has lost over half of its value in less than 12-months as market confidence in active fund managers has drifted, the Ukraine invasion has just compounded a deteriorating picture, however we would argue that as the macro picture becomes more complex, the time is nigh for active managers, particularly those with a value bias such as Platinum.

The stock trades on a forward P/E of 10.1 and again the forecasted 11% yield has probably caught some local dividend hungry investors napping. The stock looks very cheap around $2, but it’s not for us at this stage.