Retail stocks & whether or not mid-caps will be best in 2022?

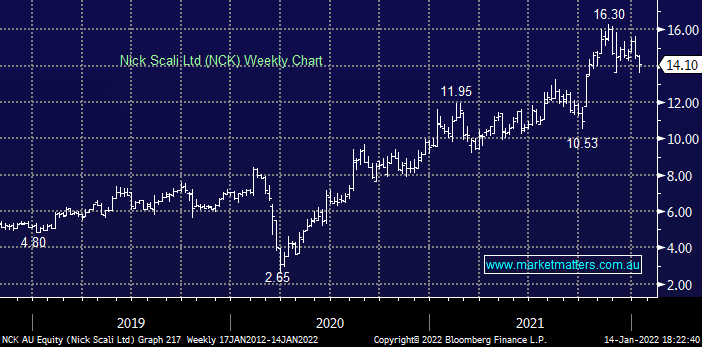

Hi James and Team, Two questions that are sort of interrelated: 1. Over the last week most discretionary retail stocks have corrected close to 10%. Is it time to jump in or should we be nervous as these retailers are coming off high Covid sales and now post Covid headwinds. I am especially interested on NCK and CCX. 2. Then on a similar tack, could 2022 be a year that is better for mid / small cap stocks rather than large ASX top 20 stocks? Or put another way, if you were to buy an ETF would you go for a vanilla ASX ETF or an ASX Small Cap ETF? Keep up the great work, Charles