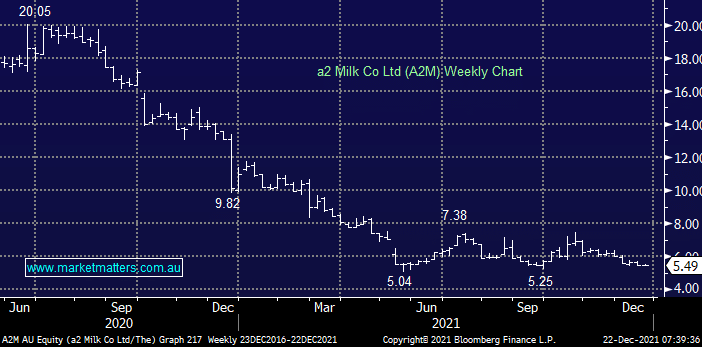

Unfortunately, not all MM holdings are success stories, unlike FMG this was disappointingly one, we bought this falling knife way too early, even if it had already more than halved. However the risk / reward feels ok around $5.50 and we’re likely to give this position a little more room into 2022. It might be a long time until it tests our $8.18 entry level but we like the risk / reward around here especially as China makes a few policy tweaks to suit itself of course.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM can still see A2M above $7 in 2022, however view this as a higher risk play

Add To Hit List

Related Q&A

Thoughts on a2 Milk (A2M) and National Storage (NSR)

Thoughts on A2Milk & Mesoblast

A2M, HUH, NVX, APX

MM’s view on PointsBet (PBH) & a2 Milk (A2M)

Is A2M a buy again?

Reviewing some “losers”

Stocks to lighten as I increase cash

What stocks would we top up here?

Making the tough decision to sell

Question on EVN & A2M

Muted class action on A2M

Tax loss selling in A2 Milk (A2M)

MM thoughts on A2 Milk (A2M) & EML Payments (EML)

What’s our plan with A2 Milk (A2M)

Thoughts on funeral operator IVC, WPL & A2M

Should we just cut A2M?

ALL, CTD, CGC, A2M

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.