Hi Mac,

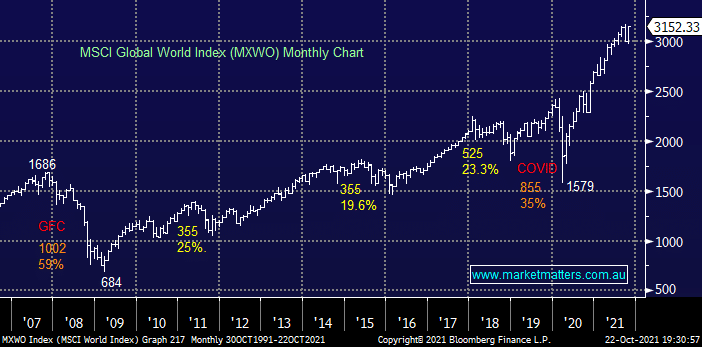

I believe we have to look at the whole market and macro picture in a broader sense, equities and risk assets have had the kitchen sink thrown at them over recent years but the central banks printing presses have overcome all the headwinds, the fact that the global market is sitting over 30% above its pre-COVID level is an extraordinary performance and I feel with the exception of a few specific company plays the largest contributor to below par returns for investors over recent years has been de-risking too soon i.e. cash has yielded basically zero while stocks have soared.

The point is it may be China, or it could be any number of factors which lead to the next 20% correction but all we can advocate is keeping our fingers on the markets pulse and being both open-minded and flexible to move down the risk curve when the risk / reward dynamic suggests its appropriate, but for us cash is not king just yet, although it may well be at some stage in 2022 – watch for our alerts as usual, we will have no hesitation increasing our cash position when we feel its appropriate