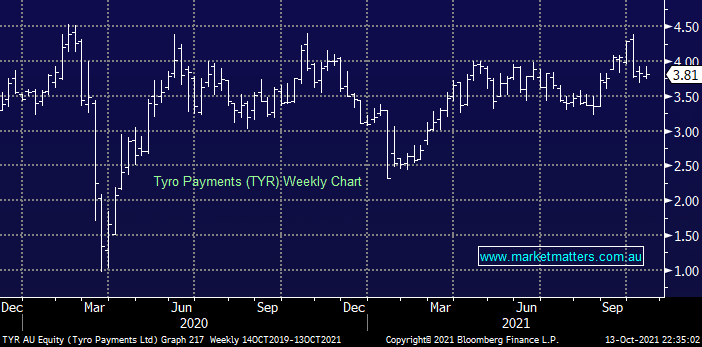

Transaction processing company TYR has been discussed a few times by MM since its listing in late 2020 and it currently resides in our Emerging Companies Portfolio – we still like it but having gone long well under $2 we cannot get too excited as buyers closer to $4.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is mildly bullish TYR

Add To Hit List

Related Q&A

Buy/Hold/Sell

Thoughts on IEL, LOV, FDV and TYR please

TYR SCG CCP & RMD

Your thoughts on TYR, MFG & CCP please

What are your thoughts towards the TYR situation?

Is TYR being regarded as BNPL stock?

Thoughts on TYRO (TYR) Payments?

Emerging Companies TYR and ZIP a hold or sell?

Does MM see trading Opportunities in ELO, EML or TYR?

Is it time to take tweak some positions?

Questions on Tyro Payments (TYR), Northern Star (NST) & Neometals (NMT)

TYR & LVMH question

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.