The Market Matters Global Macro ETF Portfolio Tracks our top 10 global macro calls, and provide avenues to trade them via ASX and internationally listed Exchange Traded Funds (ETF’s) – Click here to view

MM’s Global Macro ETF Portfolio was up 0.99% for the week, again the currency had a negative influence (-0.36%), although not as pronounced as the International Equities Portfolio. Cash sits at ~5%.

This is another portfolio which is now largely positioned in accordance with our views across financial markets, with one new ETF under consideration at this point in time:

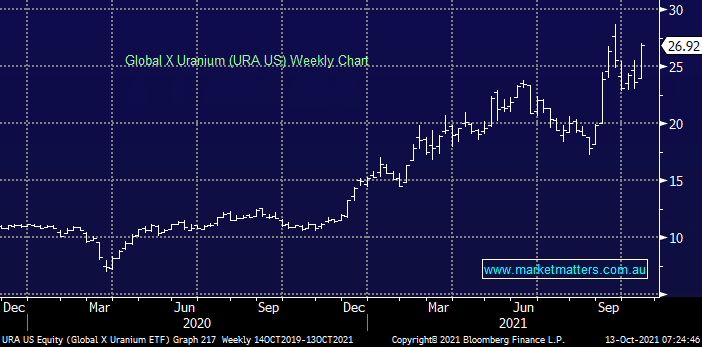

- US traded URA ETF – We are like this uranium ETF which looks to track companies involved in both mining and production of nuclear components. Another way to ‘play’ physical Uranium is through the SPROTT Physical Uranium Trust, although their OTC listing in the US is having a few technical issues at the moment, and buying through the Canadian exchange is the way to go for now.