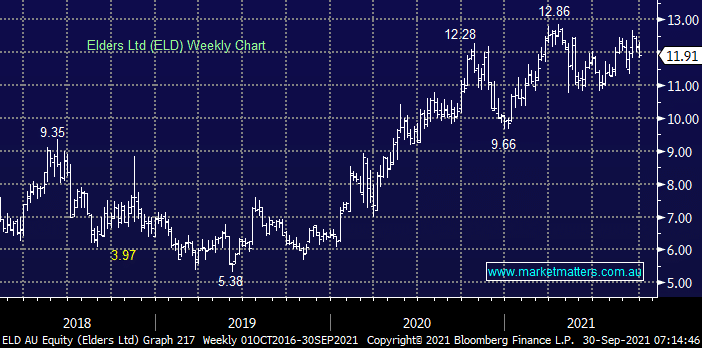

ELD’s comprehensive footprint covers farm & rural insurance, commodity exchanges, and property / farming equipment sales. Hence by definition ELD is a great proxy for the health of the Australian Agricultural Sector and not surprisingly this South Australian based company has enjoyed a strong few years where COVID was no more than a blip on the radar. We like this $1.8bn sector goliath which comes with the added bonus of a steady greater than 3% yield, the issue is price / valuation. We like ELD under $12 but its far more exciting below $11.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM likes ELD into weakness

Add To Hit List

Related Q&A

Elders

Elders (ELD)

Does MM believe Elders (ELD) has seen a bottom?

Have Elders (ELD) shares hit the bottom?

MM’s thoughts on Elders (ELD) please

Which does MM prefer ELD or GNC?

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.