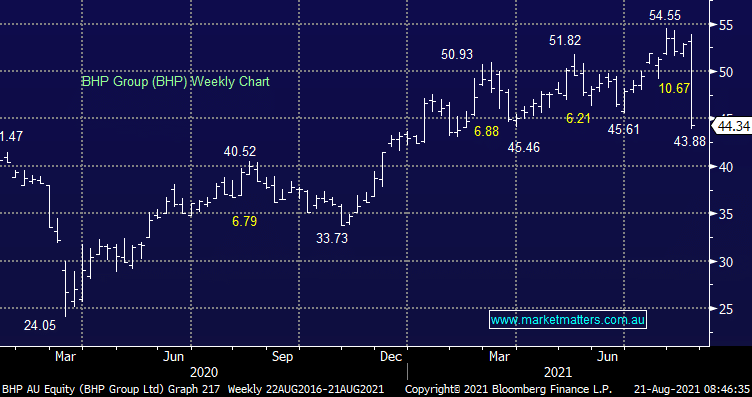

BHP had a terrible week falling ~16% after announcing FY21 results, the unification of their structure, the proposed spin out of their Petroleum division to Woodside and a large Potash investment all at a time when the Iron price collapsed and is now down ~30% from it’s 12 month high.

To answer the BHP questions and get the view of our Analyst, Peter O’Connor from Shaw, I sat down with ‘Rocky’ on Friday morning for a quick ~10min podcast following his meeting with the CEO & CFO of BHP.

The conclusion being that this weeks update will prove unequivocally positive in the longer term while the big short term moves have now played out given the closure of the gap between the UK and Australian listings. In Peter’s view, a ~5% difference i ‘about right’ i.e. the UK shares should be trading at a 5% discount to Australian shares given tax and franking credit issues. The fate of the stock from here will now be a function of commodity prices.