The Lithium Sector has significantly outperformed the broad market from the pandemic panic lows in March 2020, investors have been clambering over themselves to gain exposure to sustainable energy investing i.e. the relatively new acronym ESG Investing stands for “Environmental, social and corporate governance”. Many fund managers have been mandated to actively switch their investments away from fossil fuels into ESG investments creating a whole new industry in its wake and massively depressing the likes of coal stocks over recent years. However not surprisingly after such a huge migration of monies last month we saw in the Bank of America Fund Managers Survey report that 25% of those asked believe the ESG space is the most overcrowded space, marginally below Tech but well above Bitcoin.

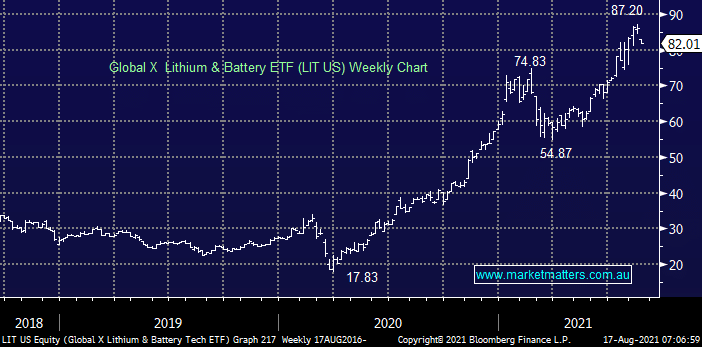

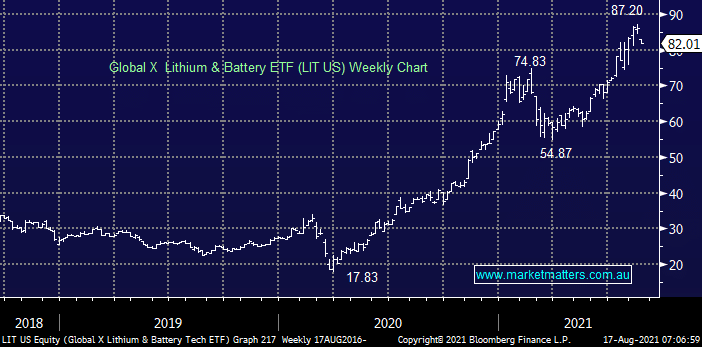

However, while I feel it is undoubtedly on overcrowded area it’s hard to imagine fund managers performing an about 180considering the future of our planet although not doubt individual stocks exposed to the sector / theme will travel very individual paths. The $US4bn LIT ETF showed us last night what can happen when too many investors are pointing in one direction as it fell 6% below last week’s high – at this stage our ideal entry level is around 76, or another 7% lower. In a relatively new industry such as lithium there is undoubtedly a sound argument for investing via ETF’s to spread the risk as some companies will undoubtedly fail plus volatility is likely to be lower across a basket of names however “the big goals” won’t be scored.