Month: August 2019

Healius (HLS) +5.02%; Not a lot of new news coming from Healius today after they provided an update a few weeks ago, confirming profit would be in the range of 93-95.5m. Today’s $93.2m result was just within the lower end of expectations. Their guidance for FY20 was for profit growth on FY19 however market consensus already implies […]

Cochlear (COH) +3.93%; The hearing aid manufacturer had a reasonable result despite a slowdown in sales over FY19. Cochlear still managed to add 13% to net profit in the year, however the bulk of the profit was generated by increases to revaluation of innovation investments. Guidance was solid, with consensus right in the middle of their FY20 […]

Stock BlueScope (BSL) $11.05 as at 19/08/2019 Event Australian steel producer BlueScope has tumbled today on their full year result, falling as much as 10.8% early in the session before some buying found its way in. The result was in line for the full year with NPAT coming in marginally ahead of expectations however investors […]

Orora (ORA) -15.94%; The packaging company followed its peer Pact Group (PGH) down the gurgler today. It was a big EBIT miss despite revenue being in line. The outlook statement was also worrying. The company talked about “challenging market and cost headwinds” which talks to a miss to the markets consensus ~5% EBIT growth in […]

Whitehaven (WHC) -3.16%; The EBITDA line was a ~3% beat to expectations and shareholders were rewarded with a nice 30c dividend – 17c of which was a special, a good outcome for our Income Portfolio where we own the stock. Closely watched was a spike in costs which were largely expected to at least flat line, […]

Woodside Petroleum (WPL) -6.73%: Weaker production levels hurt WPL’s first half result today with LNG maintenance an issue. 2H production should pick up but still a decent miss on most levels. The dividend was poor as were most metrics, however they have spoken more favourably about the likely 2H run-rate. WPL have a lot of […]

Super Retail Group (SUL) +4.15%: Result in line with low expectations in terms of top line sales and profitability. Retail is tough but SUL doing a good job to grow like-for-like sales at +2.9%. The Capex spend for FY20 was guided to $90m which is big, more investment online plus in better store footprints while they […]

Treasury Wines (TWE) +2.17%: Result more or less in line with market expectations for FY19 with top line slightly off v consensus which flows through to a slight miss at the EPS level – although not significant. As is often the case with TWE, they talk a big game on the conference call and this time […]

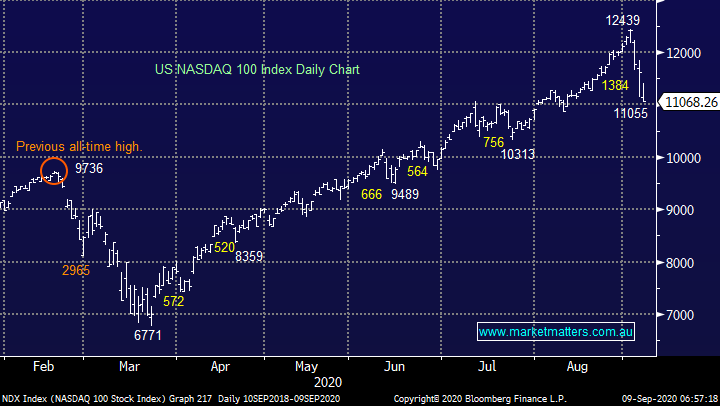

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.