Month: October 2018

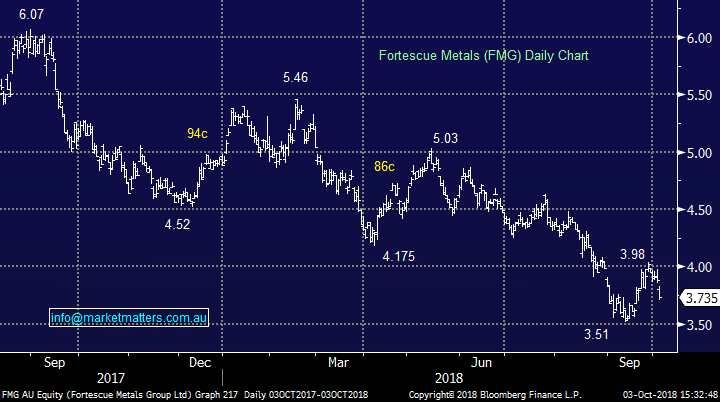

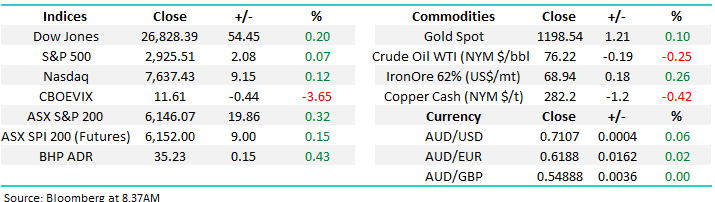

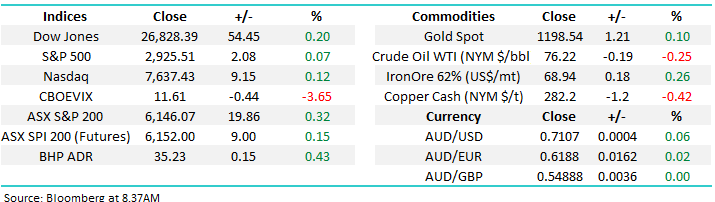

Stock Fortescue (FMG) $3.74 as at 3/10/2018 Event Fortescue has taken a hit today, off -3.61%, following the release of Morgan Stanley’s (MS) deep dive into the business and the iron ore market. MS initiated coverage on the stock with the equivalent of a sell and a price target that was ~16% below yesterday’s close. […]

While the debate rages around the abolition of cash refunds from franking credits, property stocks are being thrown around as the obvious beneficiary if a change were to occur. Over the last month the property sector has underperformed the market on an accumulation basis (including dividends) and that’s been the theme this financial year to date. While it’s easy to be negative property at the moment given the headlines around prices – and we’ve certainly held that view for some time – we like to go ‘against the grain’ and right now the market seems to be collectively bearish the sector. Does that present an opportunity?

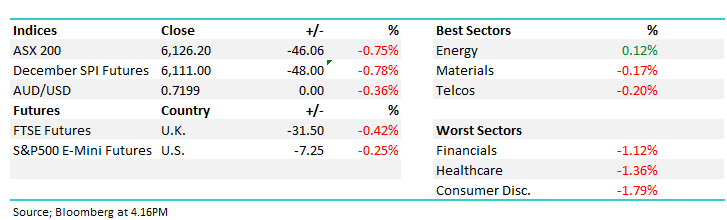

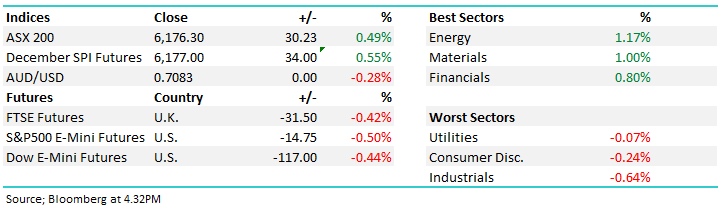

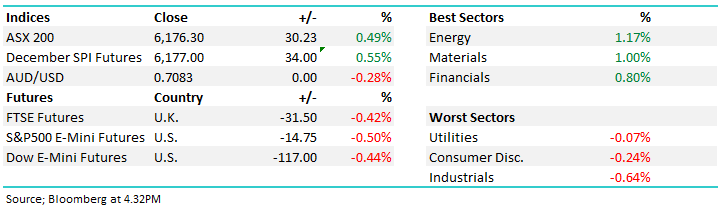

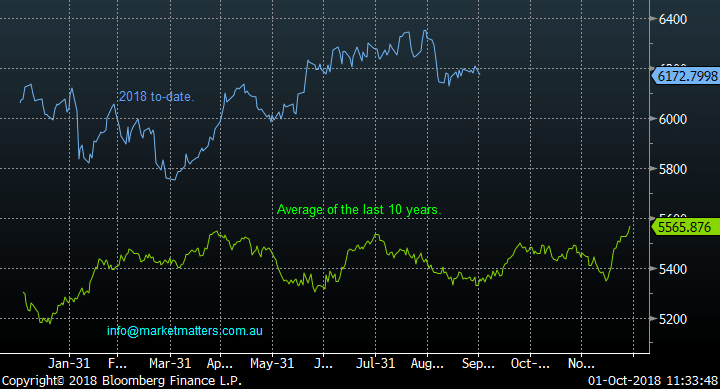

The ASX200 has theoretically left behind one of the weakest periods of the calendar and entered a far more upbeat time of the year. Many more seasoned investors can be forgiven for becoming nervous on the mention of October having witnessed the 20% plunge in 1987 but the statistics tell an overall different tale, whether we go back 10 or 50-years. Over the last 10-years, basically since the GFC:

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.