Why was Bega Cheese Ltd (BGA) downgraded

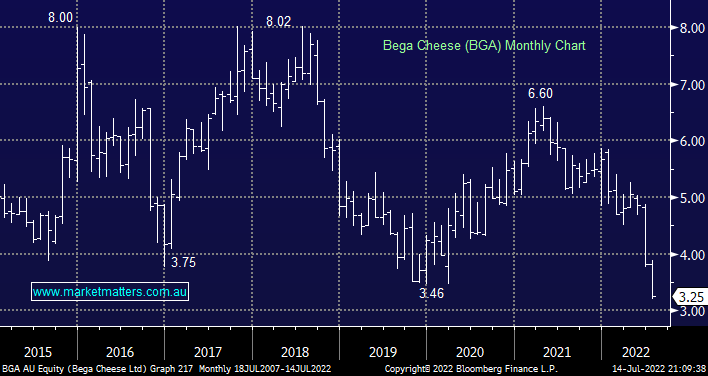

BGA was thumped -8.5% yesterday after delivering a profit warning caused by rising Victorian milk prices – the downgrade equated to ~8.6% basically exactly what the stock fell. There’s plenty of conjecture in the press overnight around how this news may have been leaked earlier allowing 3 brokers to downgrade the stock on June 20th however from our perspective all we care about is whether BGA is now presenting good value as it plunges towards $3.

- I would argue we all knew milk prices were rising like most things in Coles & Woolies, the question now is can BGA push up the price of their products by ~15%, you can just feel the RBA quiver at the thought!

- Last time we looked at BGA it was over $5 and looking solid, now it’s crashing lower and we prefer to be a spectator until further more clarity on their earnings emerges.

- UBS the morning have put through some chunky 40+% downgrades to their FY23 & FY24 earnings assumptions.