Why is James Hardie (JHX) down 15%?

James Hardie (JHX) is trading down 15% at 1.30pm, dragged lower by a brutal 30% plunge in U.S. decking peer Trex (TREX US) — the worst single-day move for Trex since 2005. The sell-off suggests that what was viewed as a secular growth industry (composite decking and home remodel materials) is now showing signs of cyclicality, competition and cost pressure, raising concerns for players across the category, including JHX.

Trex spooked the market with guidance showing:

- SG&A spend rising back to pre-COVID levels (~18% of sales vs 15.5% YTD) — signalling the start of a “marketing war” to protect share.

- Gross margins to take a 250bps hit in FY26, due to mix (more railing) and inflationary depreciation — even as volume growth continues.

- Weakness in the Repair & Remodel (R&R) sector is deepening in Q4 — historically the slowest seasonal quarter anyway.

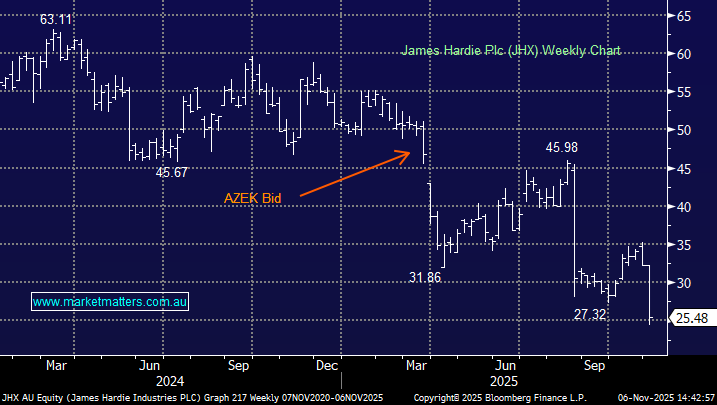

Despite being primarily a fiber cement siding business, ~70% of JHX earnings come from North America, and it’s exposed to similar R&R cycles, housing affordability, and competitive dynamics. James Hardie’s own acquisition of AZEK (a rival decking and cladding maker) now looks even more expensive.

The commentary from Trex suggests:

- Volume pressure in R&R is intensifying.

- Competitors are increasing channel incentives and marketing.

- Margins are vulnerable as cost inflation meets weaker demand.

Barclays’ note called out a “preview of competitive dynamics to come”, directly linking this risk to James Hardie.

James Hardie was already in the naughty corner after its last earnings miss and guidance downgrade. The Trex fallout now compounds that, showing cyclicality and cost pressures are more systemic than one-offs. With U.S. housing trends still murky, and now concern about a potential “race-to-the-bottom” in marketing and channel spend, the stock could face yet more pressure.

We like JHX for its long-term runway in siding share gains, but right now the risk-reward has deteriorated. High volatility, cyclical sensitivity and M&A execution risk are all front of mind.

James Hardie was already in the naughty corner after its last earnings miss and guidance downgrade. The Trex fallout now compounds that, showing cyclicality and cost pressures are more systemic than one-offs. With U.S. housing trends still murky, and now concern about a potential “race-to-the-bottom” in marketing and channel spend, the stock could face yet more pressure.

We like JHX for its long-term runway in siding share gains, but right now the risk-reward has deteriorated. High volatility, cyclical sensitivity and M&A execution risk are all front of mind.