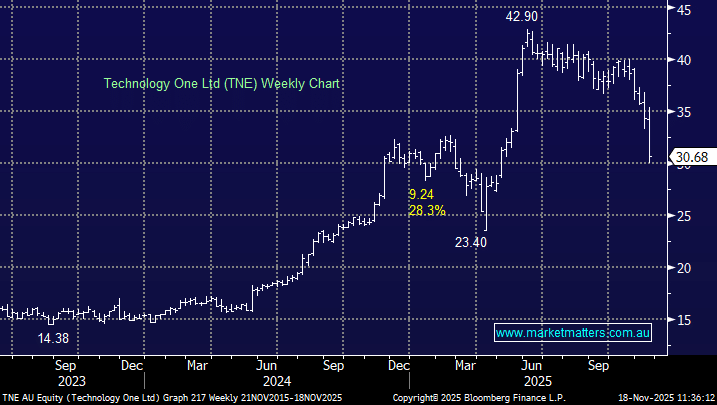

Why is Technology One (TNE) down ~14%!

Technology One (TNE) is down ~14% trading into lunch time on Thursday after missing revenue growth expectations:

- Total recurring revenue growth of 18% was a miss to 21% consensus estimates.

- Pretax profit of $181.5mn was +19% YoY, in line with $181.5mn estimates.

- Also, the company released no specific FY26 guide.

When a stock is trading on 68x, 40% above its 5-year valuation, even after today’s fall, this rate of growth is a concern in a market comfortable to deliver value contraction to tech stocks that fail to meet lofty expectations.

The 53% growth in free cash flow is much stronger than the 36% growth expected by the market, but this was only due to in-advance billing growth and the pull forward of creditor payments. The subsequent special dividend of 10c part franked did little to placate investors.

- We are now adopting a neutral stance towards TNE.