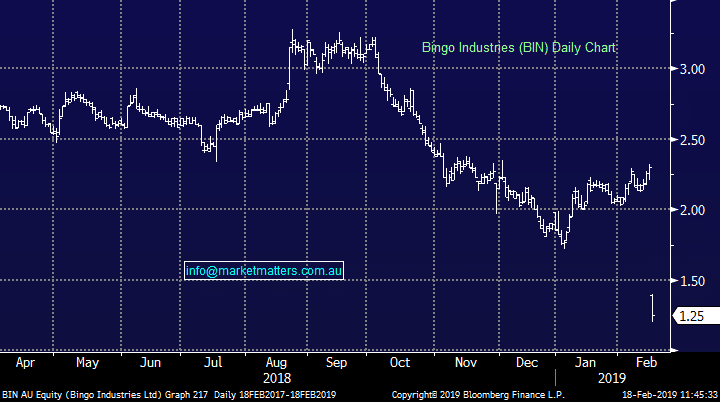

Why is Bingo (ASX:BIN) down 45% today

Stock

Bingo Industries (ASX: BIN) $1.25 as at 18/02/2019

Event

The waste management company has been savaged by the market today following a significant downgrade to full year expectations ahead of their half year results due out next week.

Bingo revised their EBITDA guidance to be broadly flat on FY18, down on previous guidance of 15-20% growth. Part of the issue is that the market was well above the company’s guidance, and for the full year had priced in around 35% growth.

Management sighted poor construction activity particularly in housing, no price increases for the year and development & redevelopment project delays.

So is this a just a delay in Bingo’s growth or is it a structural issue that could continue to impact the company in the medium term?

Firstly, the construction activity issue is something that Bingo cannot control, it is cyclical but will likely take time to play out.

The lack of a price increase is a business decision from Bingo, which planned to raise prices at the same time as the Queensland waste levy was introduced. As the levy is yet to come into effect, and won’t until next financial year, Bingo hasn’t increased pricing in the current financial year – an issue, but not a long term one. Finally, the development delays aren’t ideal but also should not been seen as ongoing, and will help lift FY20 significantly.

Doubly disappointing for Bingo is the progress that direct competitor Cleanaway Waste (ASX: CWY) made at their half year result released last week. CWY jumped over 13% on the day as profits rose strongly and guidance for the second half was solid.

Up next is the ACCC ruling on Bingo’s proposed takeover of Dial-a-dump which is expected later this week.

Bingo (ASX: BIN) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook