Why higher US interest rates are good for our market!

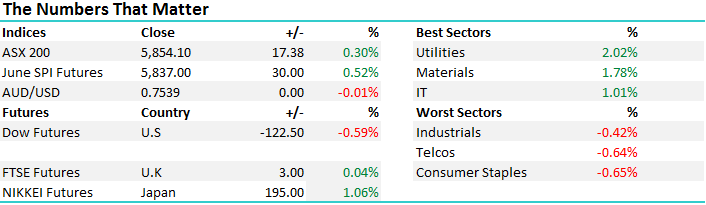

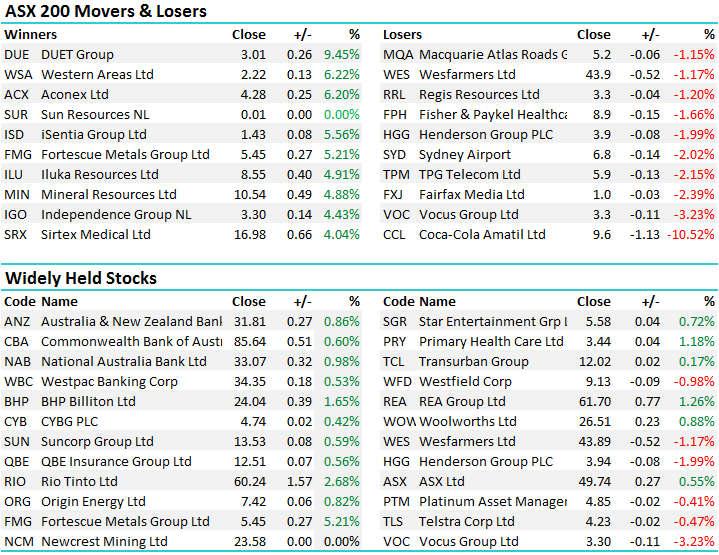

A good session for Aussie stocks today to cap off a fairly volatile week which saw decent selling early on before a recovery in the last two trading days. Overall the index finished down around 0.5% for the week however there were some big ranges from individual stocks. The much loved defensive ‘bond’ as some like to call it – Telstra – had a 30c range or a fairly significant 7.21%, BHP had a 3.24% range, RIO slightly more volatile at 4.77% and CBA ticked around by 2.37% – so clearly some volatility playing out under the surface.

On the market today we rallied early on then consolidated gains throughout the session with a range of +/- 38 points, a high of 5870, a low of 5832 and a close of , up +32pts or +0.56%.

ASX 200 Intra-Day Chart

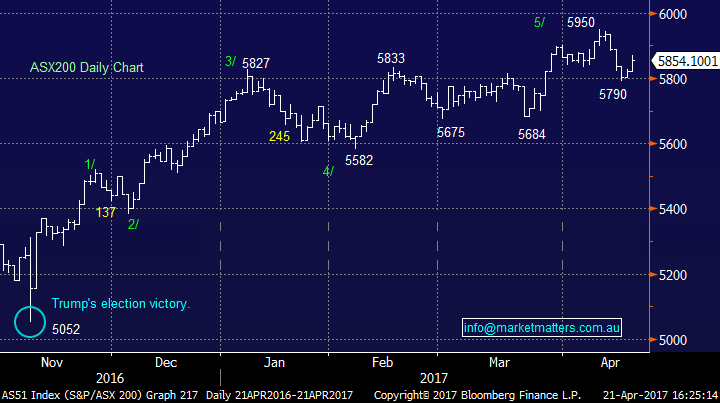

ASX 200 Daily Chart

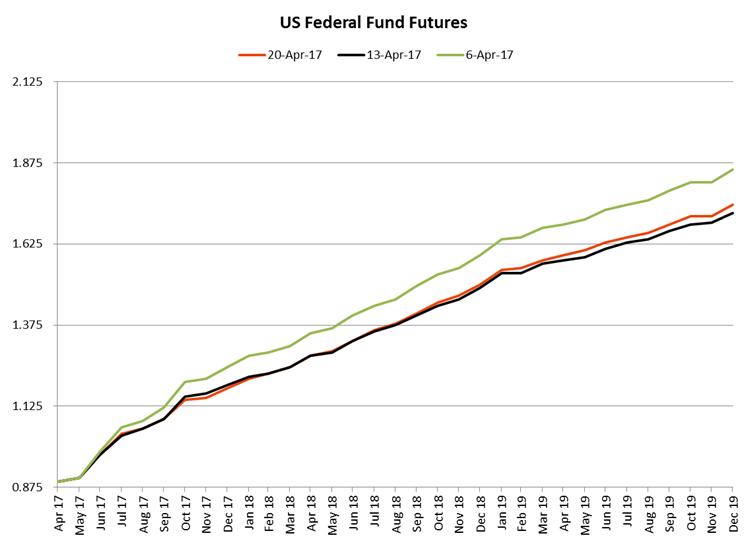

Unsurprisingly the financial sector led the charge today as expected following a very good move in the US overnight. Financial stocks generally benefit from higher interest rates as we detailed again in the morning report today and overnight we saw US rates tick up a tad, and that was enough to support the sector. We continue to remain bullish the financial stocks and have a high allocation in the Market Matters portfolio…This chart from Shaw and Partners Research which tracks Fed Fund Futures is interesting and clearly shows the likely path for US interest rates. It’s pretty clear they are going higher, it’s just the pace and extent that has the market somewhat guessing.

US interest rate expectations

Source: Shaw and Partners

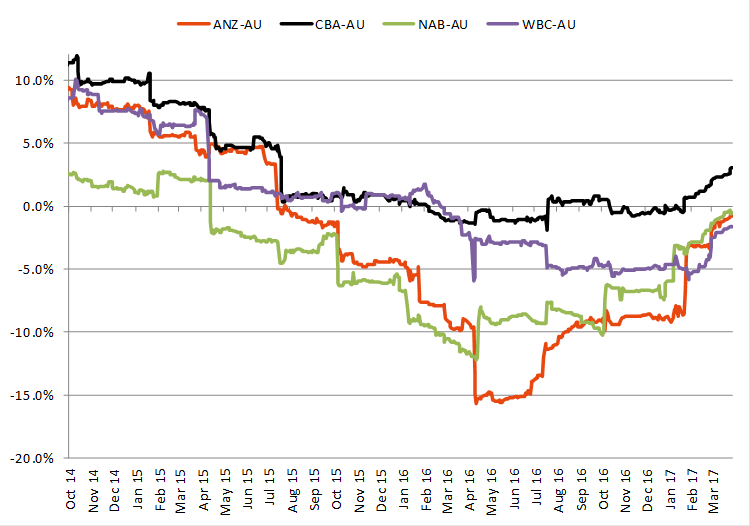

This creates a positive backdrop for our banks given it relieves pressure on margins + we have banks repricing their mortgage books higher independent of the RBA which further supports their earnings. Banks are clearly in an earnings upgrade cycle – a bit of a sweet spot right now – and that should be very supportive of our index given their large influence.

Bank Earnings Expectations – market getting more positive bank earnings - ANZ the BIG mover

Source: Shaw and Partners

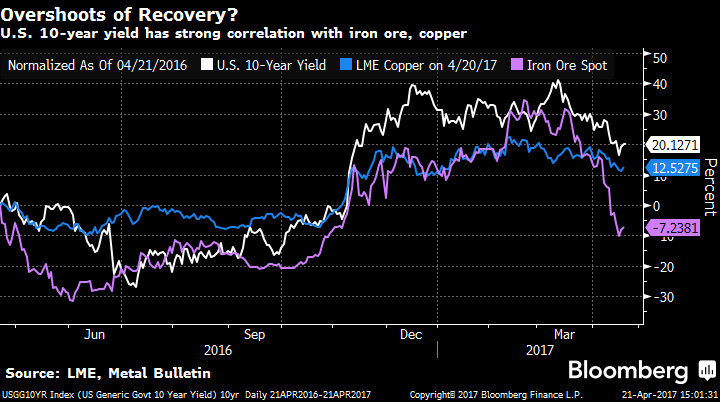

The other part of the puzzle then is the miners, and we’ve clearly had some headwinds in recent weeks. The Iron Ore price has fallen off a cliff dropping over 30% and obviously the miners have come back with it. An interesting chart popped up on Bloomberg this afternoon around Iron Ore and Copper price compared to US Treasury yields – or interest rates in other words. There is clearly a very high correlation between Iron Ore and Copper prices to interest rates, which makes sense. Interest rates go up when growth is strengthening and in an environment like that, demand for commodities should also go higher.

The interesting aspect right now through, is the extent that Iron Ore has dropped in the last week or so relative to Copper and US interest rates. There is an element of ‘supply side’ concerns which we understand given the amount of new ore hitting the market however from experience such high correlations don’t often falter in a such a short period of time. Iron Ore was up strongly again today ~6% in Asian trade and although Iron Ore stocks were strong, they could have been better.

So clearly, rising interest rates could be good for both financials and miners, which are the dominant sectors on the ASX. It’s one of the reasons why we think the ASX will outperform for the first time in many.

Turning to individual stocks today, Oz Minerals (OZL), which we own had a decent rally following their Q1 production numbers however the main aspect of the announcement (and we sighted this as the catalyst for the stocks when we bought it) was more detail on their Carrapateena project which is slowly capturing the markets attention. In terms of production, it was actually a bit light on however it was rain affected and it was only Q1….We continue to like OZL at current levels.

Oz Minerals Daily Chart

And finally, it’s good to see less Australian’s drinking soft drink although shareholders would potentially think otherwise following a weak trading update today which sent shares -10% lower . CCL said that H1 profit would decline, however they said full year numbers would be broadly inline with last year. Clearly there is some structural rather than cyclical headwinds for CCL and to us, it’s a question of ‘why own such a business’ at this juncture.

Coca-Cola (CCL) Daly Chart

Have a great Weekend and keep an eye out for the Report on Sunday

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/04/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here