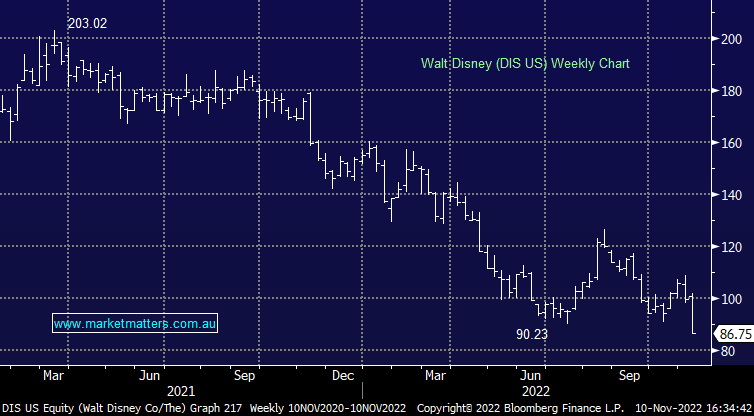

Why did Walt Disney (DIS US) shares crash?

DIS -13.16% Q4 results out after market on Wednesday with the negative reaction overnight warranted. The only positive was subscriber growth in their streaming business ~30% above consensus which implies their target for achieving streaming profitability in fiscal 2024 should become reality. Still, the rest of the result was weaker than hoped with theme park margins softer and their broader direct to consumer (DTC) business which includes global advertising sales, overseas media assets, streaming and syndicated TV missing earnings expectations. Clearly this is a big company that is being impacted by the broader macro environment leading to a ~5% revenue miss and more at the earnings line, however we continue to believe that Disney is best positioned to win in streaming supported by the best depth of content.

Wondering what Market Matters are buying and selling today?

Market Matters breaks down the latest financial developments into simple, actionable opinion that our members can rely on. We give our community access to some of the most trusted financial professionals in Australia and crucially, we invest in our own portfolios – putting real money where our mouth is.

Led by James Gerrish, the Market Matters Investment Team has decades of market experience, and every day we’ll give you our take on the market. With in-depth market analytics, clear buy, hold and sell actions members can quickly see the stocks we like, the stocks we don’t and the history behind every one of our decisions.

See for yourself – take an obligation free 14 day trial of our service – here.