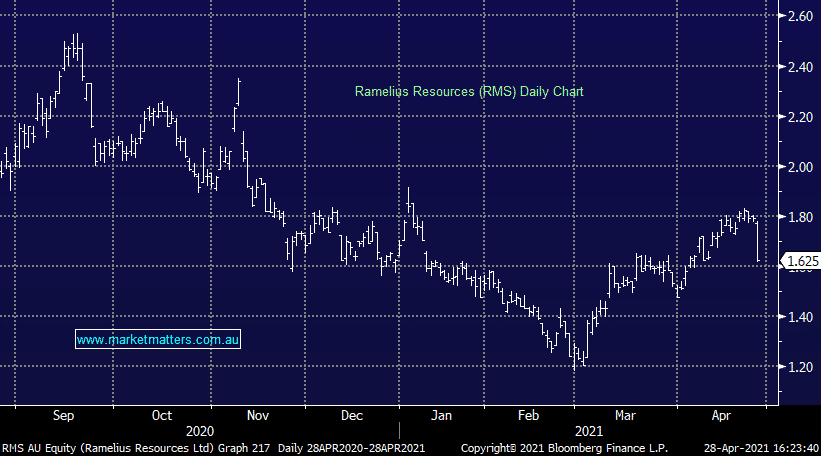

Why did Ramelius (RMS) shares fall today?

RMS -9.22%: The gold names were broadly weaker today however WA based Ramelius was the hardest hit on a mixed March quarter update. The company pushed gold production guidance to the top end of the range for the full year on a big 66koz of production the quarter just gone. That did come with increasing cost guidance to the higher end of the range of $1,280-$1,330/oz after being slugged $1,370/oz in the March quarter. The theme is a common one among the miners who are being forced to pay up for labour in a tight market. Ramelius has a handy cash balance of $230m with just $8m in debt – a balance sheet they have been aggressively putting to work with a number of acquisitions and exploration spend which is unlikely to slow down any time soon.