Why BREXIT is a good thing!

WHAT MATTERED TODAY

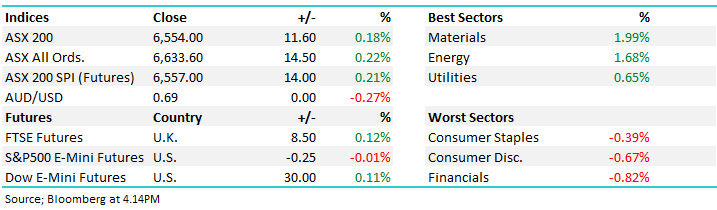

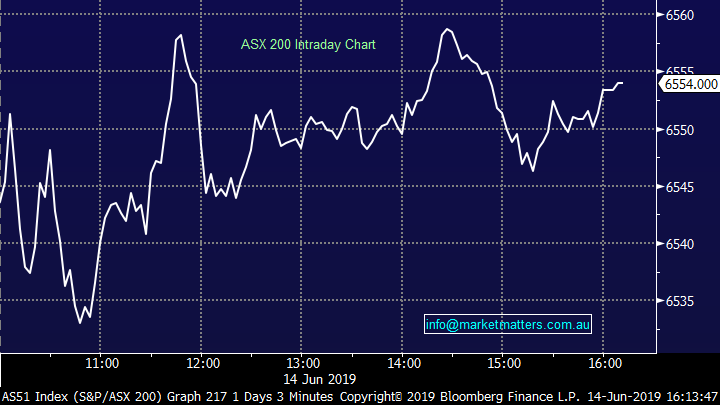

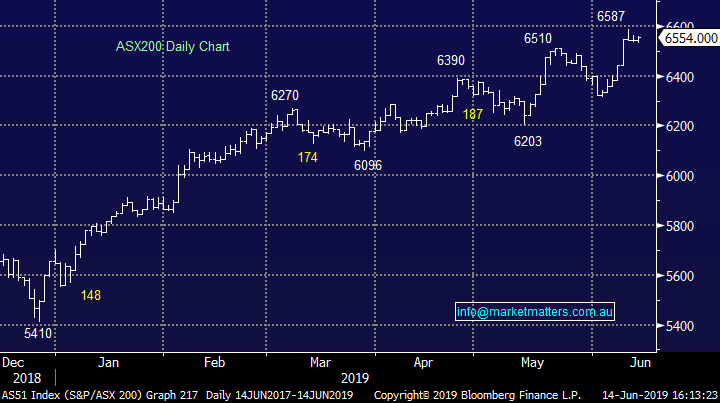

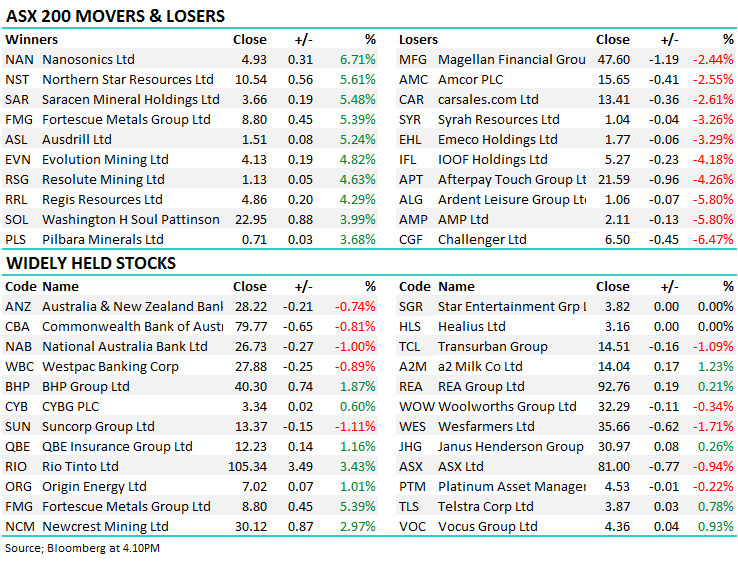

Early this week the local market soared to register the highest close since late 2007 before some consolidation played out at the back end of the week. Today was similar to yesterday with the market trading in a fairly tight range, ultimately ticking around par before closing slightly higher. Asian markets were tad weaker today, US Futures were up smalls while volume on the ASX was fairly low. That said, there was a fair amount of action at the underlying stock level today with the resources – particularly the Iron Ore names rallying strongly as Iron Ore traded up at $US110/t - BHP trading above ~$40, RIO above ~$105 & FMG nearly at $9 the obvious standouts.

Another stock doing particularly well this week, and fortunately we hold in the Growth portfolio is Bingo (BIN). The waste management business was upgraded by Evans & Partners this week with a very bullish price target of $3.44 - the stock rallied to a $2.14 high today which is above our previously suggested target, however we remain bullish with the company hosting a site tour on the 26th of June the next catalyst. .

Overall today, the ASX 200 closed up +60pts at 6443. Dow Futures are trading up +38 points or 0.15%

ASX 200 Chart

ASX 200 Chart

In the Media

I had a very interesting week, chatting with Steve Jacobs & Rupert Lowe in two video’s available below.

Rupert is the ex-Southampton Football Club Chairman turned BREXIT Party member & newly elected member of the European Parliament. He is at the coal face in terms of BREXIT negotiations in the UK and provided some insight into why the UK should part ways with. Europe. His newly formed party has attracted strong support in a short amount of time and he firmly believes that BREXIT will happen this year. It was an interesting ‘pro-BREXIT’ chat.

BREXIT – an inside take with Rupert Lowe of the BREXIT Party & newly elected member of the European Parliament

Steve is the Chairman of global asset manager BTG Pactual with more than $55bn under management. Steve’s also on the board of EFG International and more recently, he’s taken on the role of Chairman at Shaw & Partners. Steve is an incredibly well credentialed and regarded global investor, and I had the opportunity to hear his insights first hand on Thursday.

Key trends in global markets – Steve Jacobs, Chair BTG Pactual, Chair, Shaw & Partners

CATCHING OUR EYE:

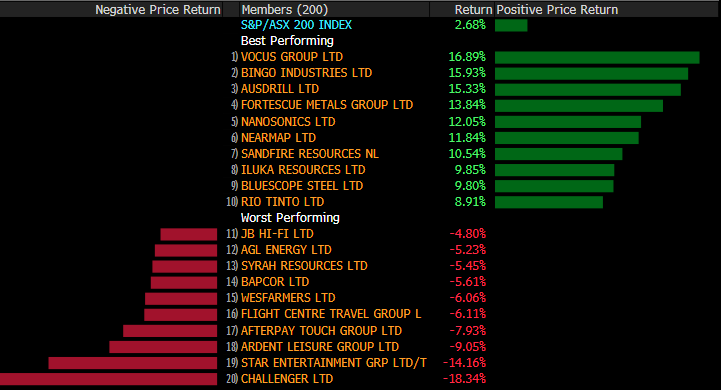

Sectors this week: A strong week for the market bouncing +2.68%

Stocks this week: Challenger’s woes for all to see

Some of the notes we published during the week

Star Entertainment (SGR) slumps; the casino operator downgraded earnings as VIP spend drops. Click Here

AfterPay raises capital; before AUSTRAC issues yesterday, APT was reaching into investors pockets. Click Here

Emeco (EHL) shares rally; shares in the earthmoving business have struggled lately, but rebounded this week. Click Here

Challenger (CGF) downgrades; the investor day focus was on a poor earnings outlook. Click Here

Direct From the Desk: I covered off on the impact of interest rates in a quick update last Friday: Click Here

Broker Moves;

· Wesfarmers Downgraded to Sell at Deutsche Bank; PT Set to A$31

· Wesfarmers Downgraded to Sell at Goldman; PT A$30.50

· Wesfarmers Cut to Neutral at Evans and Partners; PT A$34.14

· Challenger Upgraded to Buy at Morningstar

· Challenger Downgraded to Hold at Bell Potter; PT A$7.34

· AGL Energy Upgraded to Hold at Morgans Financial; PT A$17.85

· Steadfast Downgraded to Sell at Morningstar

· Coca-Cola Amatil Downgraded to Sell at Morningstar

· Sims Metal Upgraded to Buy at Citi

· Bluescope Upgraded to Buy at Citi

· AMP Downgraded to Underweight at Morgan Stanley; PT A$1.80

OUR CALLS

No changes today

Watch out for the weekend report. Have a great night,

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.