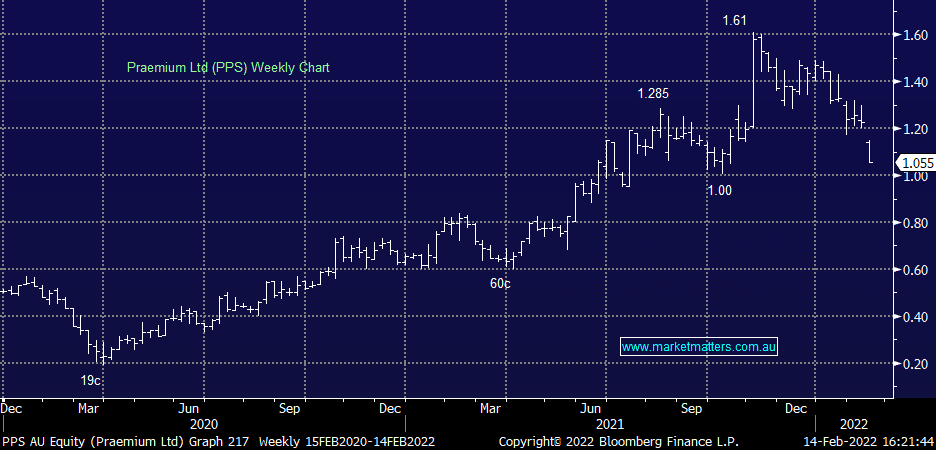

Why are Praemium (PPS) shares falling?

PPS –13.88%: fell to 4-month lows toady on the back of a soft 1H result. Revenue at $39m was a touch behind, but margins fell and EBITDA of $7.5m was around a 15% miss to expectations. The lower margin Powerwrap business is having a bigger impact on group margins than originally expected while costs are also creeping higher with operating costs up $7m in the half. This has also weighed on guidance which was provided for the first time. Praemium expect FY22 EBITDA to come in between $16.5-18.5m, 15% below consensus at the midpoint. While today’s result has clearly reset expectations, the outlook remains positive. Praemium seeing significant inflows which should lead to operating leverage. There is also the interest from competitor Netwealth (NWL) which made an offer late last year. I suspect we haven’t seen the end of that story just yet and another bid is likely given the consolidation in the space.