Whitehaven production numbers soft – unemployment rate tick up to 5.5% (WHC)

WHAT MATTERED TODAY

Not really sure what to write about this afternoon given we’ve seen a similar trend play out today than recent days – Wall Street strong, our mkt OK on open before sellers get the upper hand throughout the session + we saw the mkt whacked on the close. Sometimes when you write a morning note, and afternoon note, send out trade alerts + do a weekly income report you get void of ideas, and right now, I’m paddling that boat. Interestingly enough, I had a good chat to a subscriber today, a lovely gent who sent us a hamper at Christmas and couldn’t be happier with the MM service, who commented on the amount of content going out, the transparency of our views, the accuracy of most and the hardworking nature of the MM team. We love hearing that and although we certainly won’t ever please everyone, we do our best to write realistic and authentic content each and every day. Thanks Paul – this afternoons note may be a disappointment!

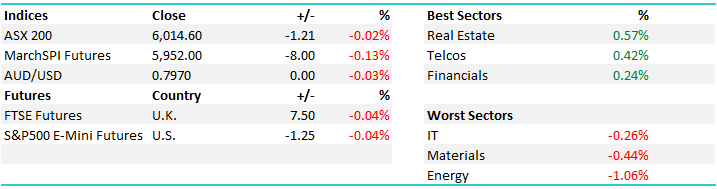

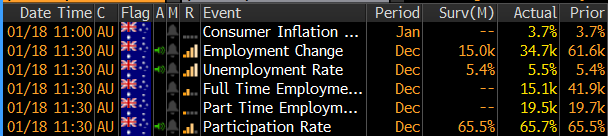

On the economic front we did see employment data out today with the unemployment rate ticking up to 5.5% from 5.4%, however the participation rate was strong so the data today was not really a representation of a weakening labour market. The Aussie dollar volatile, SELL being the first response on the headline unemployment rate before the details were digested and the mkt bid it back up. Early on today the currency pushed up through US80c which is a 5c gain in a touch over a month – which is a big move. More on the currency (more so the $US below)

Aussie Dollar – Daily Chart

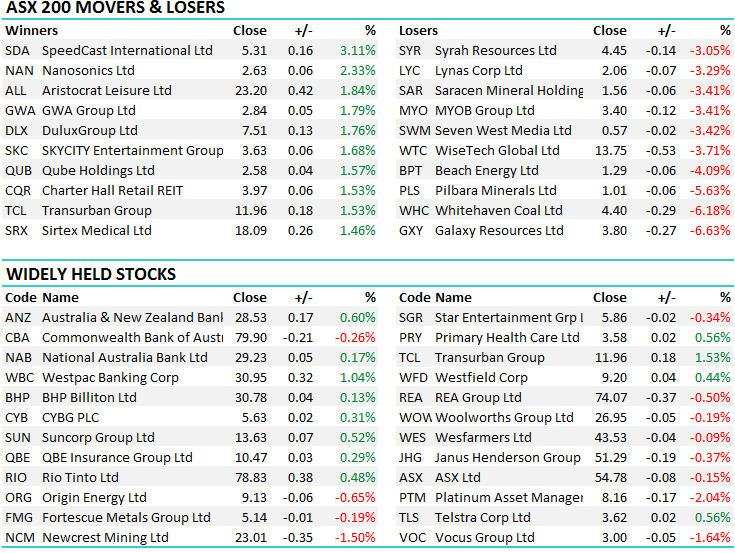

Overall, the Real Estate stocks were strong today in a relative sense while the Energy stocks struggled. An overall range today of +/- 21 points, a high of 6035, a low of 6014 and a close of 6014, down -1pt or -0.02%

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATHCING OUR EYE

1. White Haven Coal (WHC) $4.40 / 6.18%; A poor day for the coal producer following a weaker than expected set of Q4 production numbers with a few key points. OK quarter but a few key (not so flattering takeaways)

1. LOWERED guidance from 22-23mt to 20.5-21mt … NOT a GOOD headline.

2. Narrabri (major prodn source) – mining issues = lower prodn and HIGHER costs (+$2/t)

3. Cost pressures elsewhere – aim to limit to $1-2/t

And more holistically, met coal price has finally cracked – down 10% this week alone + steel maker margins have compressed as well . Overall this now looks a decent SELL and should trade lower if the heat comes out of the commodity space, which it will at some point.

Whitehaven (WHC) Daily Chart

2. Currencies; The $US has broken down towards the 90 area as we anticipated, taking gold and most $US denominated commodity prices higher. The obvious question for us is where do we expect it to stop?

· The weekly trendline support comes in around the 86-87 region.

· The last major monthly pullback was around 2010 and was 16-points, which would target ~88.

· The daily picture, which is accelerating lower, targets the mid-high 80’s region.

· Gold seasonally is usually strong from now until the end of February.

While the $US Index remains below 91.8 we expect a test of 86-88, however note gold / resources may top out before the final low in the $US depreciation.

You can play this trend through the USD.AXW on the ASX and we’ll write about this + will send out a video next week discussing the trend, and the ability for us to take advantage of it.

US Dollar Index

OUR CALLS

No changes to the portfolio’s today. We remain ont he buy side of Zipmoney which closed 2 cents above our limit.

That’s all for today….

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/01/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here