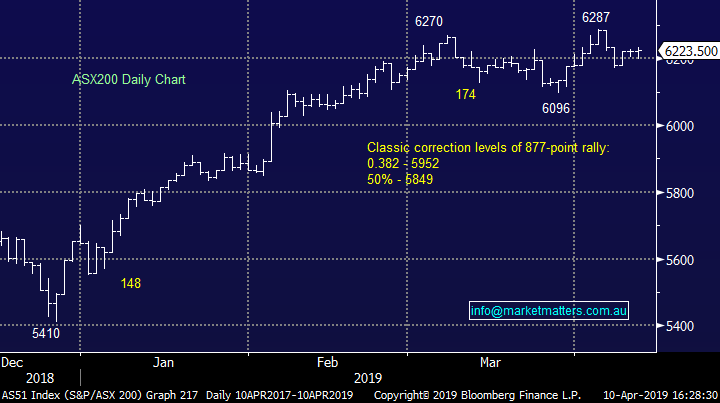

When the RBA the talks AUD listens (IFL, DMP)

WHAT MATTERED TODAY

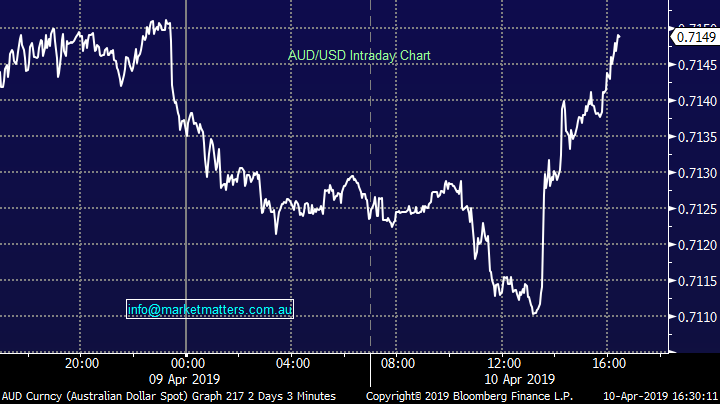

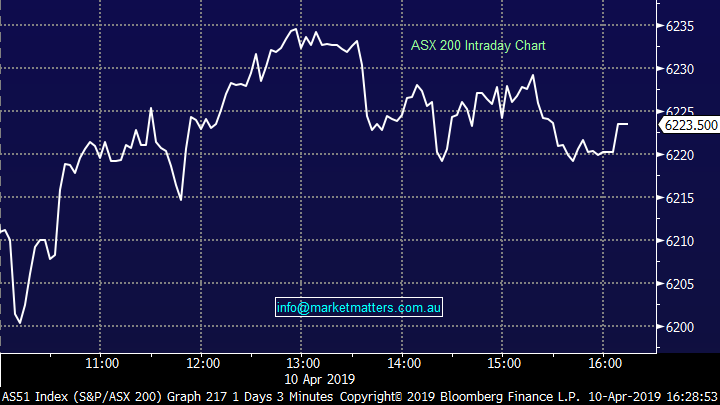

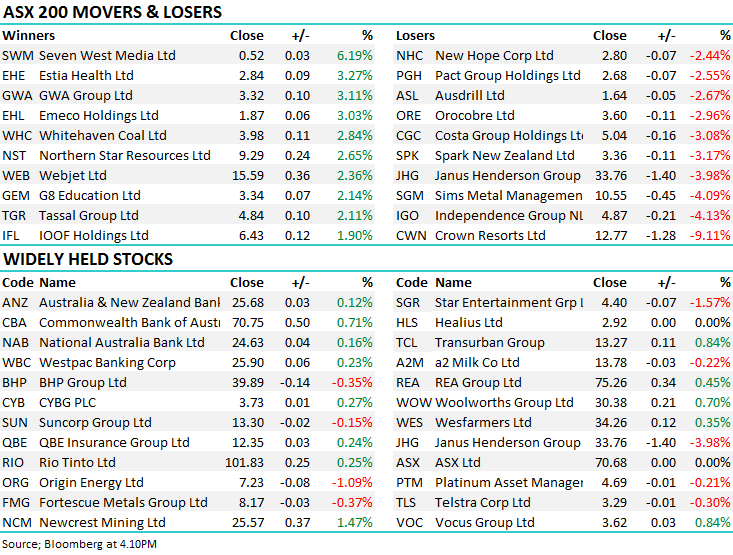

The market brushed the weakness seen overnight to trade around even for much of the session. Just like yesterday it ebbed and flowed around 6220 handle on the ASX 200 with very little conviction for the market to push on in either direction. Today it was the banks offsetting the miners in a reversal of yesterday’s trading. Over the past 48 hours, the ASX200 has traded in an extremely tight range of 36 points and volumes seem light. Traders have one eye on US reporting which kicks off at the end of the week, while volumes are light suggesting some have gone on the Easter road trip a few days early.

Westpac’s consumer confidence index was out mid-morning and surprised to the upside, jumping back above the 100 point mark vs an expected print of 97. With the figure, Westpac noted that those surveyed after the budget showed higher readings than those before. This helped the consumer discretionary names trade higher, only dragged by Crown (CWN) which reported Wynn had walked from takeover talks.

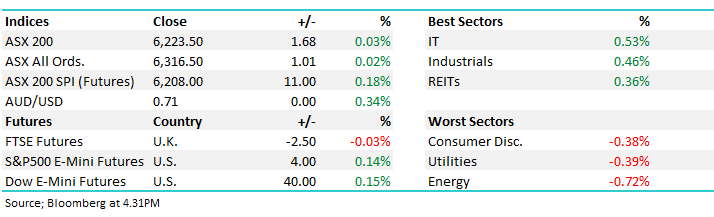

The focus today was on the speech by deputy governor of the RBA Guy Debelle. He touched on a number of topics throughout the speech, but the main sticking point was the time he spent on the disconnect between unemployment and growth at the moment. “The strength of the market is at odds with the slow pace of GDP growth… the labour market could be a lagging indicator. But at the same time, businesses continued to invest through the end of 2018… forward looking indicators suggest future employment growth will remain solid.” This was enough to see the Aussie dollar jump higher mid-afternoon with traders believing that there is less need to drop rates given the comments.

AUD vs USD Chart

Overall today, the ASX 200 ended up 1 point or +0.03% to 6223. Dow Futures are currently trading up 40pts / +0.15%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

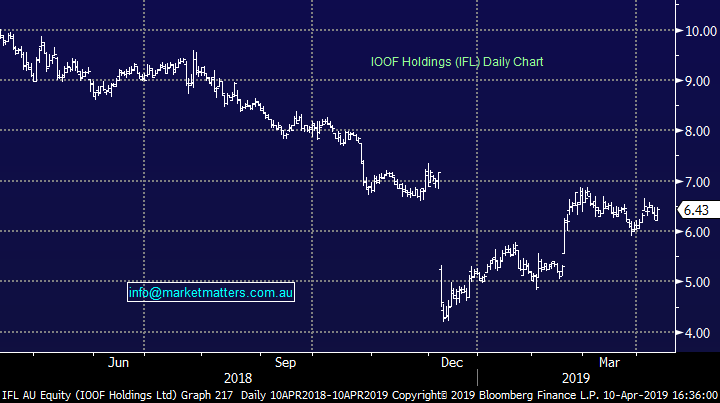

IOOF Holdings (IFL), +1.9%, announced it would be buying the Bendigo Bank financial planning book, trading higher on the news. The book includes around $1b in FUM to be transitioned over to IOOF at a cost of $3m upfront with further payments down the track subject to retention rates. To us it’s a good sign for IOOF shareholders to see the company still looking to grow despite the fallout from the Royal Commission. IOOF is still working with ANZ to get the deal for the pension business over the line while the company and some of its executives remain under a number of APRA investigations.

IOOF Holdings (IFL) Chart

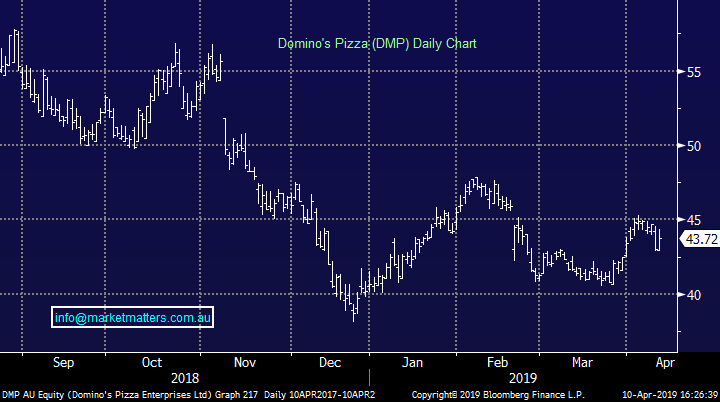

Dominoes (DMP), +1.58%, traded higher with the company announcing it would be take control of operations in Denmark. The company has bought the struggling licensee of Dominoes franchises in the Scandinavian nation after the company went into administration earlier in the year. The company is on a European growth push with this acquisition adding another 20 stores to the ~2,700 already in the continent. It hopes to open a number of new stores in Denmark and the rest of Europe to get that number up to 2,850.

Dominoes (DMP) Chart

Broker Moves:

· CSR Downgraded to Neutral at Macquarie; PT A$3.45

· Bluescope Downgraded to Equal-weight at Morgan Stanley; PT A$17

· Adelaide Brighton Upgraded to Buy at Morningstar

· Harvey Norman Upgraded to Hold at Morningstar

· Crown Resorts Downgraded to Hold at Morningstar

· AGL Energy Rated New Sector Perform at RBC; PT A$21

OUR CALLS

We reduced CBA in the Growth Portfolio. We sold Alumina (AWC), reduced Perpetual (PPT) and added Estia (EHE) in the Income Portfolio. We discussed the Income Portfolio changes in today’s income report here.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.