What happened to TPG Telecom (TPG) shares today?

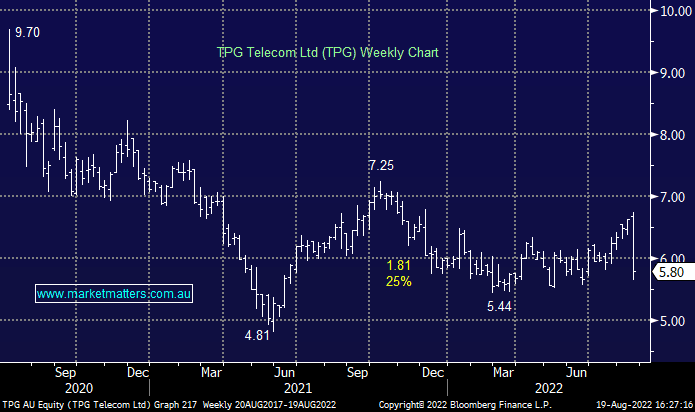

TPG -12.39%: A weaker 1H result for the telco than we hoped and the share price is unfortunately reflective of that. Revenue of $2.19bn was around 2% light on while EBITDA was a 3% miss (excluding restructuring costs relating to the Vodafone merger). The miss was a result of lower Average Revenue Per User (ARPU) and higher costs. Not all bad news though, with a 9cps interim dividend while they added +135k new mobile users which was above company guidance of 120k for the half. They talked to a better 2H however they didn’t provide actual guidance which is the main issue, the market was looking for specific financial guidance and they failed to deliver. The share price was off sharply, and while it’s a big reaction, the stock had run into the result. We’ve unfortunately seen a nice profit evaporate in our position today, however, for now, we are inclined to hold the position.

Wondering what Market Matters are buying and selling today?

Market Matters breaks down the latest financial developments into simple, actionable opinion that our members can rely on. We give our community access to some of the most trusted financial professionals in Australia and crucially, we invest in our own portfolios – putting real money where our mouth is.

Led by James Gerrish, the Market Matters Investment Team has decades of market experience, and every day we’ll give you our take on the market. With in-depth market analytics, clear buy, hold and sell actions members can quickly see the stocks we like, the stocks we don’t and the history behind every one of our decisions.

See for yourself – take an obligation free 14 day trial of our service – here.