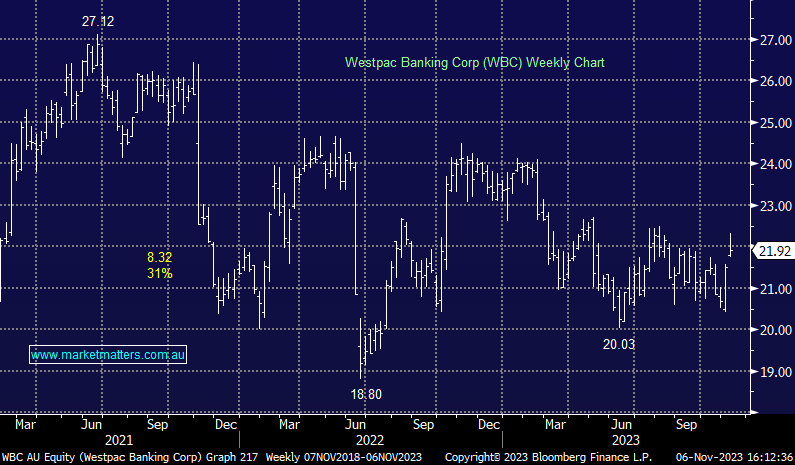

Westpac (WBC) rallies on FY23 results, buyback

WBC +1.95%: Rallied today after delivering a largely inline FY23 result, although the $1.5bn on market share buy-back announced was a positive surprise while they also made better progress on costs. Net Income of $7.2bn was up +26% YoY, a shade below consensus of $7.33bn while the 2H dividend of 72cps was ahead of expectations. Margins improved to 1.95% while a lot of focus was on the cost side, the expense-to-income ratio of 49.4% vs. 55.1% last year was better than many of the pessimistic assumptions and shows they are now heading in the right direction. Capital is very strong with the Tier 1 ratio at 12.4% vs. 11.3% last year and above estimates of 12.1%, this has underpinned a solid share buy-back.

- While earnings headwinds persist, a strong capital position and diligence on costs are supportive