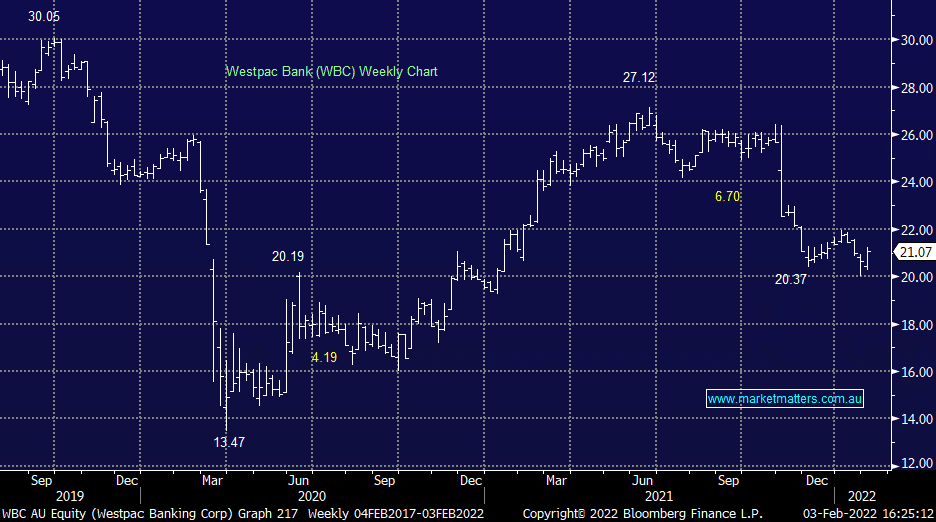

Westpac (WBC) kicks off reporting for the banks

WBC +2.28%: the first of the banks to present the quarterly update and they led the way with a strong result. Cash earnings of $41.58b was 1% higher than the 2H21 average and a 7% beat to consensus. Better Treasury and Markets revenue as well as a fall in costs led the beat. Net interest margin (NIM) was disappointing, falling 8bps vs the 2H average to 191bps, but more tan offset at the bottom line with falling headcount, lower investment spend and a vastly reduced notables charge supporting earnings. Westpac expect to continue to see costs slide throughout the year. They bumped up their bad and doubtful debt charge, largely blaming supply chain disruptions however this number looks conservative. CET1 stood at 12.2% however this will drop to 11.65% following the $3.5b share buyback wrapping up next week.