Wesfarmers unharmed after Coles break up

Stock

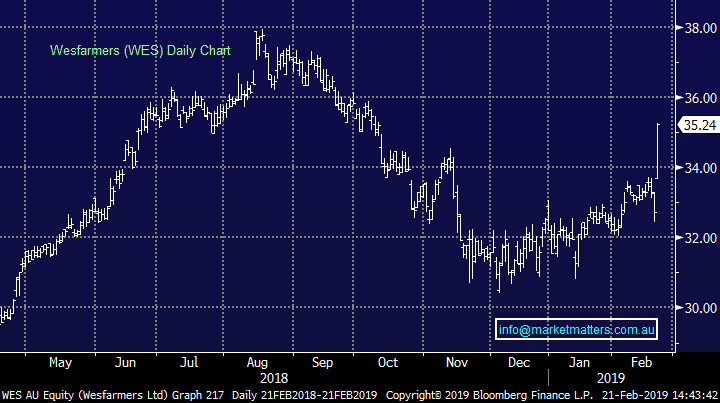

Wesfarmers (ASX: WES) $35.24 as at 21/02/2019

Event

Today marks the first report of the ex-Coles era for Wesfarmers and the key to their first half lies with a strong capital balance more than offsetting a poor business performance.

Bunnings now accounts for around 50% of the group’s earnings and is set to drive the business growth over the near term. The problem is that the growth here seems to have hit a speed bump. After adding around 8-9% like-for-like (LFL) sales over the past few years, this period managed a softer 4% growth in sales for Bunnings with the blame being pointed to wet weather and a housing slow down.

Elsewhere, Kmart & Target missed the lower end of the reported range in January which is concerning but it wasn’t enough for the company to miss expectations thanks to a decent effort from the Officeworks business. Consensus EBIT was after $1.61b while the company came in at $1.62b – not a big beat but not a miss.

The highlight for many is the $1 special dividend, to go along with the $1 interim div, working out to be 6% fully franked just for 6 months of the year. Wesfarmers ex-Coles is in a very strong capital position, even after the dividends are paid, and now go in search of acquisitions with a number of targets already being speculated.

The stock has rallied well today, continually bid up as the session goes on. It looks as though investors are climbing over each other chasing the income.

Wesfarmers (ASX: WES) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook