Wesfarmers’ trading update highlights economy’s performance

Wesfarmers (WES) +0.29%: Provided a trading update this morning which showed sales at Bunning’s up +5% for 3Q20, while Officeworks was up by 8%. Bunning’s is the key driver for WES accounting for more than 50% of their earnings and clearly the sales momentum has continued through this period of disruption. Kmart and Target sales growth for the quarter was also in line with 1H20 (i.e. +1.0% and +0.3% respectively) – however, in recent weeks sales have moderated for Kmart and “declined significantly” for Target (weak apparel sector, lower foot traffic into shopping centres etc.) – Target now looks like it’s on the chopping block, although hard to identify a buyer for it.

The business has changed since spinning out Coles and is now dominated by Bunning’s which account for around 48% of their earnings. Making up the rest is department stores (Kmart & Target) accounting for ~30%, Office works contributed another ~8%, while the industrial side of their business which is chemicals and fertilizers, industrial safety equipment and the like add another ~14%. They’ve recently sold 5% of Coles for over $1bn and now have a war chest of available liquidity, something like $4bn. While retail is clearly a problematic space at the moment and 2H earnings will be weak, at MM we’ve been spending time thinking about business that will 1. See out this current turmoil & 2. Actually, be able to benefit from it, and WES ticks both boxes.

This is a $41bn company with an almost net cash position, the WES balance sheet remains strong post Coles sell-down (+$1.1b) and extension of available debt facilities (+$2.0b) – sounds like WES is warming up for a major acquisition or two. Coles will report 3Q20 numbers tomorrow while Woollies will report 3Q20 numbers on Thursday

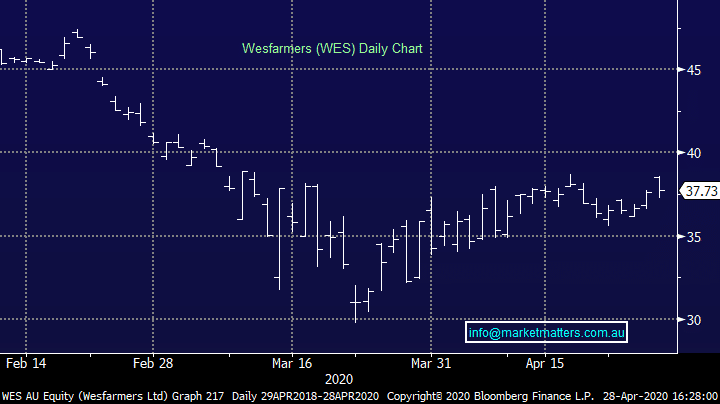

Wesfarmers (WES) Chart