Well Well Well…who saw that coming? Not us

What Mattered Today

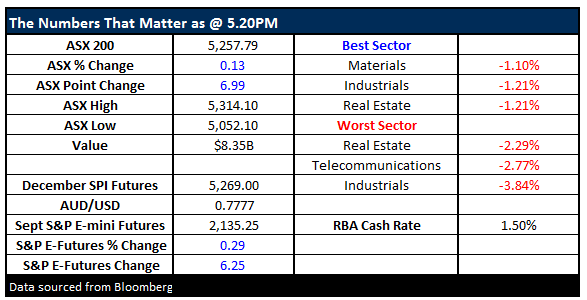

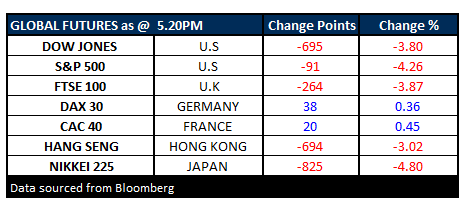

A remarkable day for America with the likely election of Donald Trump as the 45th President of the United States – an outcome that few predicted and a scenario that seemed outright ludicrous just a few short months ago. It’s not yet a done deal – as technically, Clinton could still get up, however, it seems extremely likely that after the dirtiest of campaigns Trump will confirm victory later this evening. Understandably, global markets were exceptionally volatile during today’s trading with the US FUTURES driving markets around the world. The desk was as busy as we’ve had in some time and that was certainly the case across the broader market with massive volume through the ASX – $8.35bn.

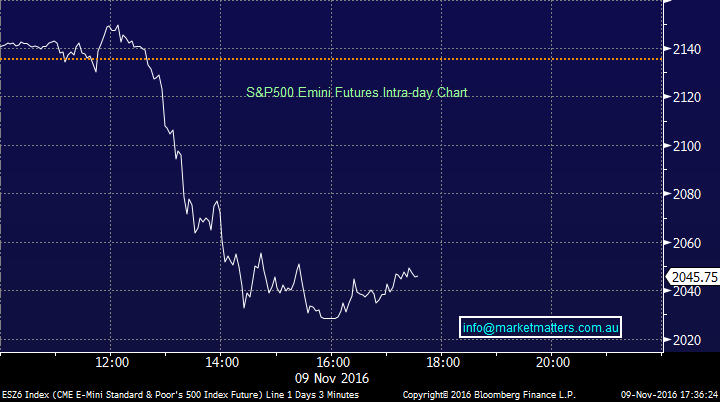

The ASX 200 swung around in a 262 point range – which is a significant 5%. The close was better than it might have been with the index finishing down -101pts or -1.92%. In the US, Dow Futures were down more than 700pts at their worst, with the S&P 500 Futures currently trading down 4.24%.

Clearly, the market does not like this outcome and the volatility will continue. Make no mistake, this is a tectonic move and speaks to the massive discontent, the frustration with the status quo, and the distrust of the ‘establishment’. No doubt a clear message for politicians around the globe.

The most obvious question now is, what will a Trump presidency look like, and how will the cards settle after an incredible day?

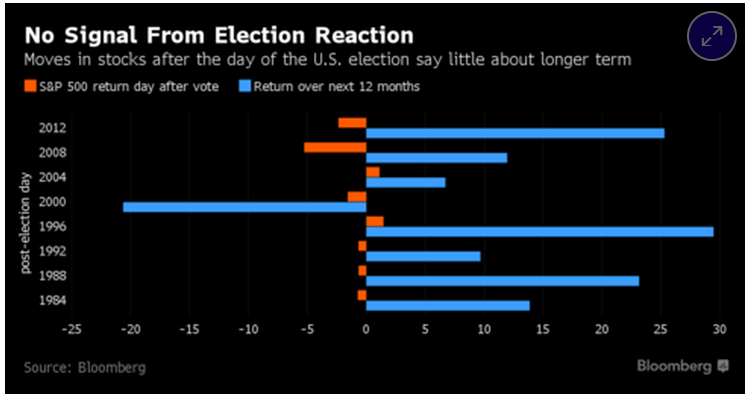

1. Firstly, the uncertainty brought about by Trump will be significant in the near term and really it’s the fear of the unknown that will now be front and center. We’ve often quoted statistics around the likely market reaction following a presidential election is decided, and we typically see markets higher in the weeks following the outcome, BUT, Trump is not your normal political situation and that roadmap may be worth very little.

2. Below is chart from Bloomberg showing the market reaction the day after an election, and the subsequent return in the 12 months following. The key takeout is clearly that the reaction on the day does not have a big bearing on the outcome for the next 12 months. The market was off 5% after Obama beat McCain in 2008.

3. In terms of the ‘Trump Policy Suite’ , we don’t have a lot of detail, however he does plan to increase spending, particularly on Defence and Infrastructure, halve the company tax rate for corporate America, introduce a series of tariffs to protect local manufacturing and be more liberal overall in terms of spending. Some of Trump’s more radical ideals will likely fail to pass through the Republican Party room but they will likely support spending and tax cuts, which will ultimately be stimulatory.

4. The other important aspect is that Trump’s a businessman, he’ll be business friendly which could be supportive of the market.

We certainly don’t want to downplay the impact of Trump, as it will be large, however if his more radical side fails to gain the support of his party, and those policies remain ideals rather than reality, while his more stimulatory programs get through, a Trump win, coupled with likely Republican control of Congress you could certainly see capital flow back into U.S corporates. A silver lining perhaps in an otherwise dark day.

We’ll write more about the potential impact of TRUMP in our morning email tomorrow…

US S&P Futures

ASX 200 Intra-Day Chart

ASX 200 daily chart

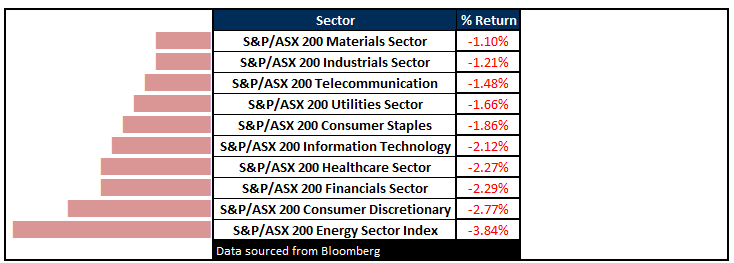

Sectors – Materials the best of a weak bunch supported by GOLD stocks only

ASX 200 Movers – GOLD as a hedge shows it’s value in days like this.

What Matters Overseas

FUTURES obviously very weak….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 9/11/2016. 5.20PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here