Volatility finally kicks up – ASX off by 55pts!

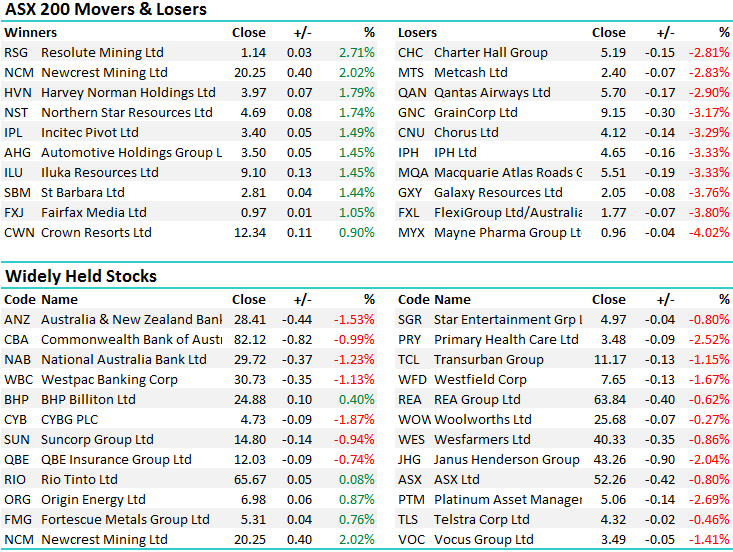

The red brush came out today with pretty much all sectors finishing down, the only bright spot at the sector level was GOLD, with the likes of Newcrest, Resolute and Northern Star all doing well, up more than 1.5% a pop. The resources generally where better in relative terms in a weak market with BHP finishing higher by $0.10 while RIO was also higher, closing out the session at $65.67, up 5c. Normally in a weak market, when selling is targeted toward the banks, we get those defensive names seeing some love, the ones we spoke about this morning – however that wasn’t the case and we actually saw decent selling in that area of the market – Westfield down by -1.67% to $7.65 and Sydney Airports down by -1.89% to $6.75 – underperforming the banking stocks which were down between 0.99% for CBA and 1.53% for ANZ.

The other area that we’ve been highlighting of late was likely weakness in the Healthcare stocks – the likes of CSL, Ramsay and the like with weakness in the US being our flag there. CSL was off another -2.54% today closing at $129.10.

On the broader market today, the Materials sector led the way while most weakness was felt in the Financials which lost -1.14% - an overall range of +/- 64 points, a high of 5730, a low of 5665 and a close of 5673, off -55pts or -0.96%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

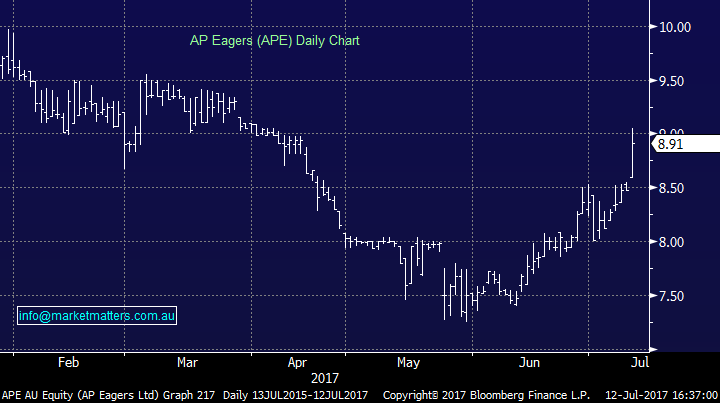

AP Eagers (APE): As mentioned in today’s income portfolio report, APE released first half results this morning booking a net profit before tax of $68.1m, which is marginally higher than this time last year (+0.3%). The market liked the result stock closed up 5.07% to $8.91 today. In May, the company signalled that poor vehicle sales in Queensland had impacted their business, signalling that pre-tax profit would fall 7-9% for the year at the lower end of guidance. Clearly this has not played out as expected after booking a record profit for the first half of the year. We continue to like AP Eagers (APE) for income with some potential for further growth.

AP Eagers (APE) Daily Chart

BT Investment Management (BTT): Today we sold BT in our growth portfolio as has been signalled in many recent reports. After buying at $11.20 in May the stock rallied before a downgrade by UBS last month halted the momentum. The technical picture for BT is weak as it failed to hold the $11 support that was established around the time of buying. We continue to have a large exposure to the financials space, however there are no holdings in diversified financials which has been tricky to navigate recently. No positions were added to the portfolio, increasing our cash weighting to 14.5%. Opportunities to put this money to work will arise if this weakness continues.

BT Investment Management (BTT) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/07/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here