Vocus in the crosshairs of private equity

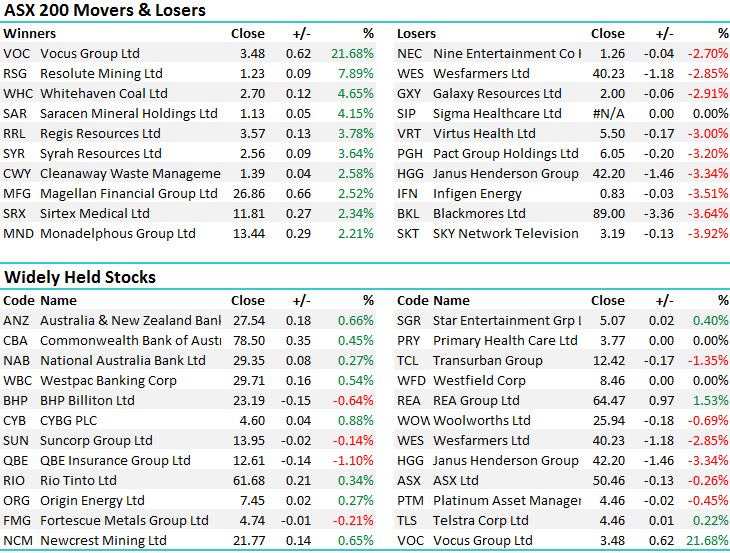

A better day for Aussie stocks with early weakness being bought, particularly in the banks which enjoyed a tentative bounce. As we suggested yesterday, the -80pt sell off yesterday as broadbased however the banks only accounted for -20 index points implying that aggression in bank selling was starting to ease, and most of the pain had already been dealt. That theme started to play out today and we saw good turnarounds across the board – ANZ the best of them adding $0.18 or 0.66%.

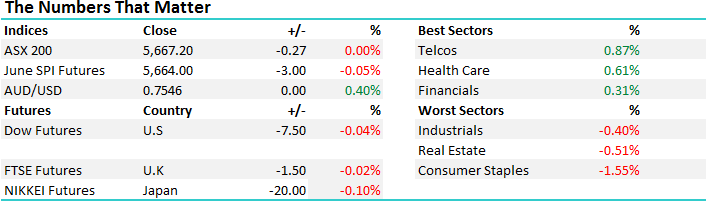

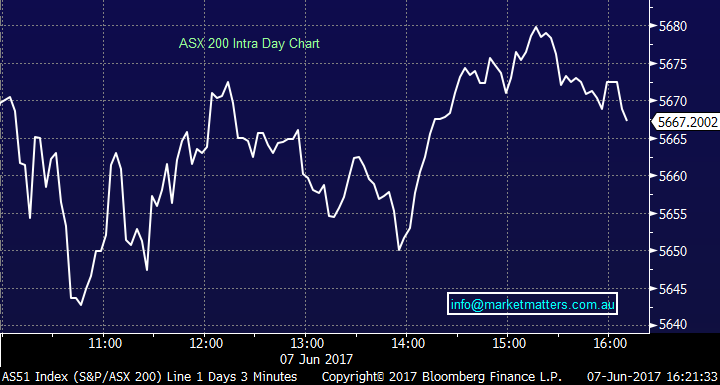

On the broader market today, the telco sector led the way while most weakness was felt in consumer staples which lost –1.55% - an overall range of +/- 40 points, a high of 5683 and a low of 5643, ending the day unchanged at 5667.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

The big corporate news was clearly the private equity bid for Vocus (VOC) at $3.50 a share, a +22% premium to the last traded price and that obviously saw some strength in the stock – which closed up by 21.68% to $3.48. KKR is the private equity bidder and rumours of a potential deal have been circulating for a while, however the main issue that was cited as a mitigating factor was around whether or not VOC would meet their earnings guidance. It was clearly a risky play given one more downgrade and the company would likely breach lending covenants, and most likely to be forced to raise equity – obviously from very depressed levels. Now a bid has been formalised the questions is whether or not a competing suitor will step up?

James Spenceley was the kingpin that started VOC and grew it spectacularly, before selling stock around $8 and stepping down following a number of big acquisitions and loss of control to M2 Management – a smart move in hindsight and now with the stock around $3 he was once again being discussed as a potential acquirer with the help of others. Spenceley however was vocal today in saying he’s been a buyer of stock on market in recent times which restricts him from leading / or being involved in any potential competing bid. RRG is being discussed in some circles as having some interest but nothing confirmed as yet.

Clearly there is some concern from the suitor KKR around VOC earnings given the bid is conditional upon the company meeting earnings guidance whilst maintaining net debt below $1.1bn (currently $1.04bn). We also know that industry players have little regard for Geoff Horth, the current CEO, and whatever the outcome he’s unlikely to be there long (in our view).

Whatever the case, VOC is clearly in play, however the price is likely to be a big disappointment for many holders. That said, the Board will need to take this offer seriously and do all they can to entice a competing bid – it’s the least they can do for long suffering shareholders. At this stage, we will sit and watch from the sidelines. We do not own VOC

Vocus (VOC) Weekly Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/06/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here