Vocus disappoints in AGM

What Mattered Today

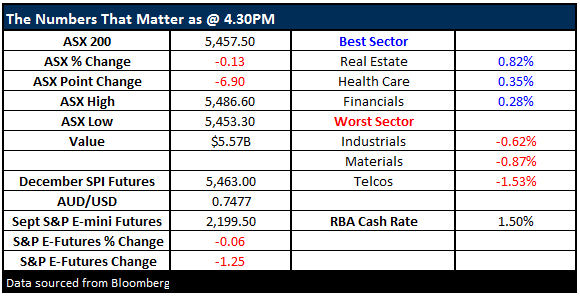

The ASX 200 closed marginally lower, with the banks unable to hold the broader market to hold in positive, while the materials and telcos were the weakest link

Today’s focus was squarely on the Telco space with Vocus (VOC) holding it’s AGM. The stock dropped sharply, closing down 26.48% to $4.35 – clearly a disappointing outcome for a company that has been under a lot of pressure in the last few months – and unfortunately, we own it in the Market Matters portfolio (+ I own it personally).

Before I get onto the intricacies of the update, the most pressing question is, what are we doing with our holding, and what should you do with yours? Firstly, we’ve clearly gotten this stock pick wrong and it’s been one of those holdings that just keeps delivering disappointments. Our thesis for continuing to hold the stock going into the AGM, was around ‘what had or hadn’t been priced into the market’ after the TPG Telecom (TPM) inspired fall from above $8.

To our way of thinking, the market had already priced in a negative update at the AGM, which left the door open for a positive surprise. The price action leading into the AGM was supporting that view, however as we’ve seen today, that clearly wasn’t the case. The selling today has been big and we’ve seen some large lines of stock being sold consistently throughout the session. Each time the stock tried to bounce, there was clearly a number of big sellers that kept offering up stock and we saw it close near enough to the lows.

Upon reflection and we’ve spoken about this in the last video update, we bought a stock that was too well owned and too well liked by the market. On the faintest sign of issues within the business, the selling volumes clearly outweighed any appetite to buy. Simply put, the majority were full to the brim with Vocus which left very few buyers.

We now have a stock that has capitulated, and some of the very bullish analysts at $8 and above, have now turned bearish – typically a sign to BUY a stock given the consensus is now clearly negative. If we had no position, or indeed a smaller position in Vocus, we would be buyers of this ‘capitulation’ event, or even allocate some funds into TPG Telecom (TPM) which has been sold down in sympathy.

Now to the numbers; VOC have given FY17 earnings guidance of $430m-$450m which is ~7% below where consensus expectations were at. The stock was trading on a PE of ~15x FY 17 consensus numbers, and we’ll now likely see analysts price it on a lower multiple, and on lower earnings and that’s why we’ve seen such a drop in share price.

The corporate business, which is the jewel in the crown continues to do well, yet they are clearly having some issues with the integration of their 5+ recent acquisitions.

Before this update, the market was expecting earnings growth of 17% in 2018 – which was clearly a bullish stance, but took into consideration recent acquisitions, we’ll now likely see expectations for growth in the low teens – which, if they can deliver, still looks appealing.

For now, we’re maintaining our holding and for those subscribers with a high risk tolerance, averaging in at / around current levels makes sense to us. Conversely, those with an especially large holding, could trim Vocus to reduce the ‘stock specific risk’ and re-allocate some of the funds into TPM which has been sold down in sympathy.

On the market today, we had a range today of +/- 33 points, a high of 5,487, a low of 5,453 and close of 5,457 down 7 points or -0.13%.

ASX 200 Intra-Day Chart

ASX 200 Daily chart

Vocus Communications (VOC) Daily Chart

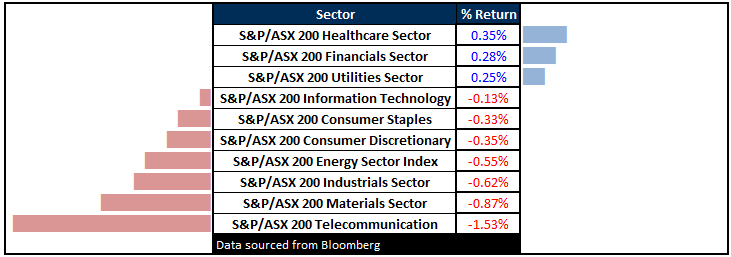

Sectors

ASX 200 Movers

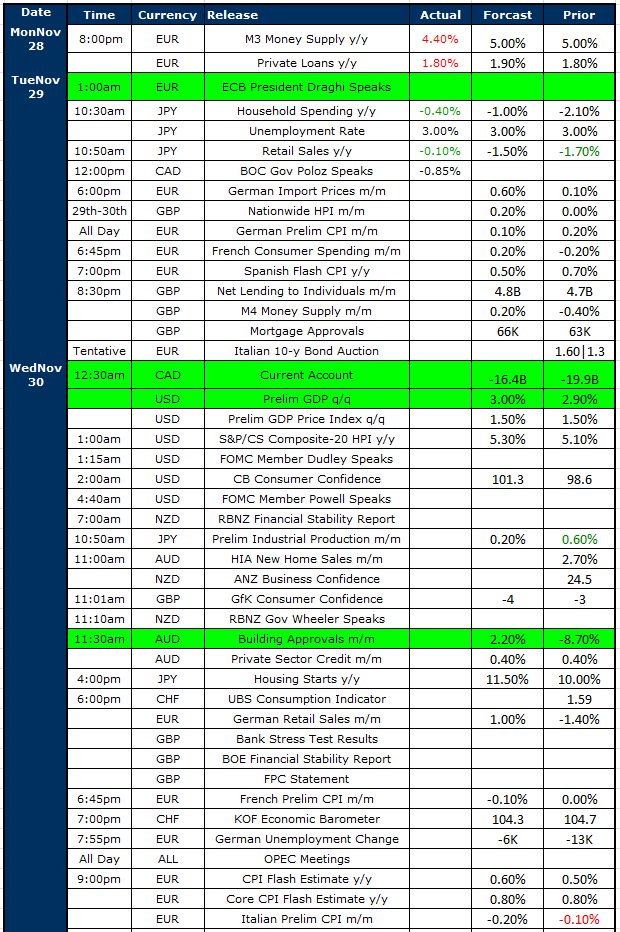

Select Economic Data- Stuff that really Matters in Green

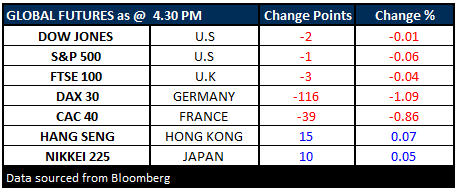

What Matters Overseas

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/11/2016. 4.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions.

You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here