Viva Energy (VEA) share price pops

Viva Energy (VEA) +15.46%: was back challenging recent highs today on the back of a profit update heading into the end of the first half. Viva provided a wide range in their earnings guidance coming in between $20m-$50m on a replacement cost basis which compares to $50.9m for the first half of 2019. Though sales through the Shell petrol station network fell but margins were higher as petrol prices managed to hold better than oil through the slump.

The commercial business took a hit with aviation weighing on the segment, and it was jet fuel sales that sent the refining business into the red for the half as well. Total fuel sales took a big hit as the lockdowns set in for April. Across the book, a total of 833m litres were offloaded in the month, around 30% below April. While May did see a recovery, sales are still subdued in all sectors. Capex has been reduced in order to help maintain margins with expectations cut in half for 2020, and maintenance on the refining side has been reduced by around 25%. Viva were keen to talk up their options with their assets, talking to an energy hub at their Geelong port. With the potential for LNG storage, battery farms and the like which sounds more deflective of the problem rather than a solidly thought out business plan. Still though the market liked the announcement with better than expected guidance. We’re 50/50 on this stock here.

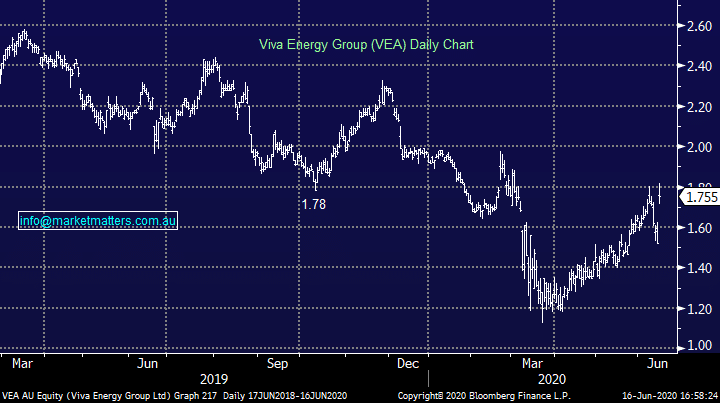

Viva Energy (VEA) Chart