Vicinity Centres (VCX) raise capital

Vicinity Centres (VCX) unch: spent the day in front of investors looking for $1.4b in additional cash with the shopping centre manager taking a hit to capital as COVID squeezes landlords. The raise is priced at $1.48 a share, around 8% below the last traded and at a value one third below reported pre-raise NTA. The raise is a line in the sand for Vicinity as it looks to sure up the balance sheet in the midst of uncertainty. The company has started re-valuing the portfolio as a result of the crisis with preliminary work showing a hit of 11 to 13% by the time the full year report rolls around at the end of the month.

The landlord said that foot traffic fell as low as 50% on last year in April, but has since recovered to around 25% down on the prior period. More than half of the retailers closed at the peak or the crisis however more than 80% are now trading. But while stores are opening, Vicinity are being pushed hard on lease variations. In the three months to May, just 49% of billings were received, leaving a hole in earnings. As a result, VCX are resigned to not paying a dividend for 6 months as they look to prop up the capital position alongside the raise. While things seem difficult for VCX at the minute, the raise will put them in a decent position, and as the economy opens up, people will return to malls and centres looking to spend. Shares trade at a discount to assets – and the raise at a deeper discount – so with the balance sheet secure, VCX now looks a better proposition.

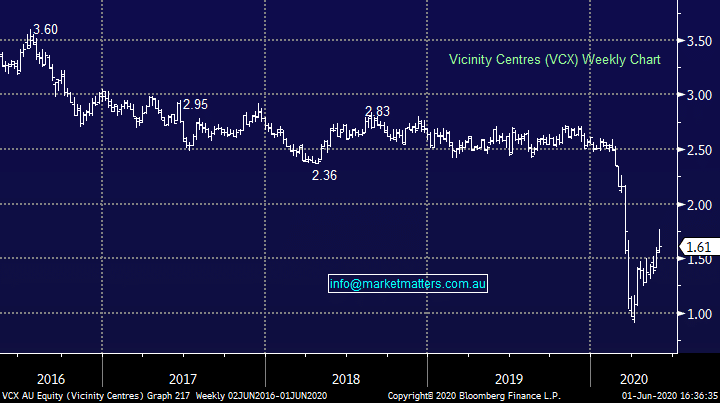

Vicinity Centres (VCX) Chart