Unstoppable (FMG, DMP, JHX)

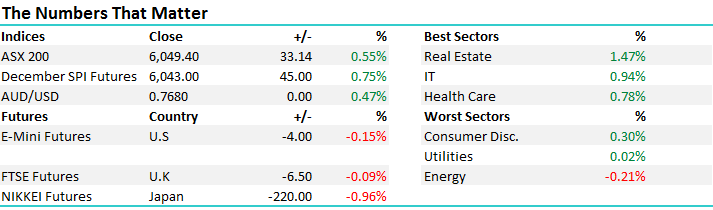

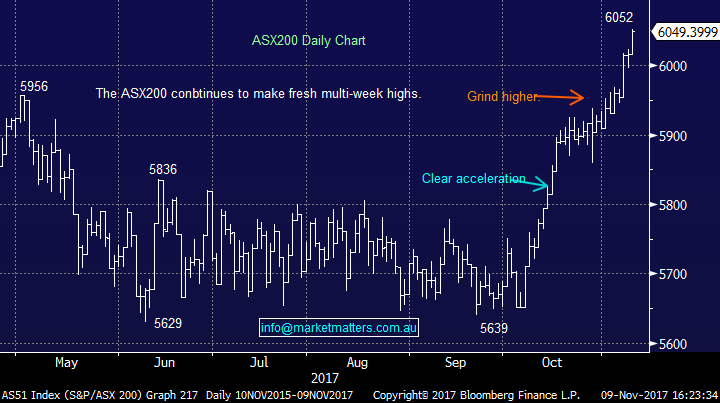

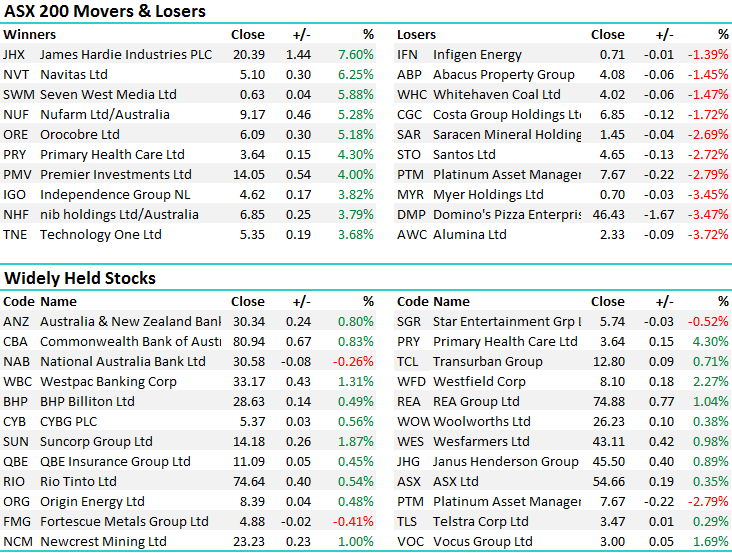

The freight train rolled on today as the market confirmed it has broken out above 6000, once again setting new 24 month highs, as the market briefly cracked 6050. NAB went ex-div 99c today, falling $1.07. Real Estate was the sector on top today after news of investor lending falling month on month, while energy was the weakest dragged by a small fall in Oil overnight and weak commentary from Santos at their investor day. Overall, a range today of +/-31 points, a high of 6052, a low of 6018 and a close of 6049, up 33pts, or 0.55%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

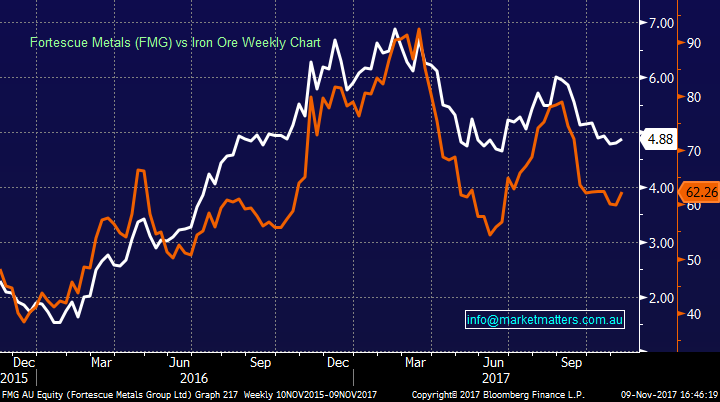

Fortescue (FMG) held their AGM today, an important one as the CEO Nev Power will leave the company in February while seeking to replace the Firetail mine that will be retired in 2021 – moving to develop their Eliwana deposit. Andrew Forest, FMGs chairman, spoke at length regarding the impact Chinese President Xi Jingping’s crackdown on pollution has had on lower grade ore prices, highlighting the disparity being paid for high and low grade ore. Twiggy’s comments however don’t seem to be reflected in FMGs share price at this stage and we see risk to FMGs earnings as a result. FMG finished down 0.41% today to $4.88.

Fortescue (FMG) vs Iron ore Weekly Chart

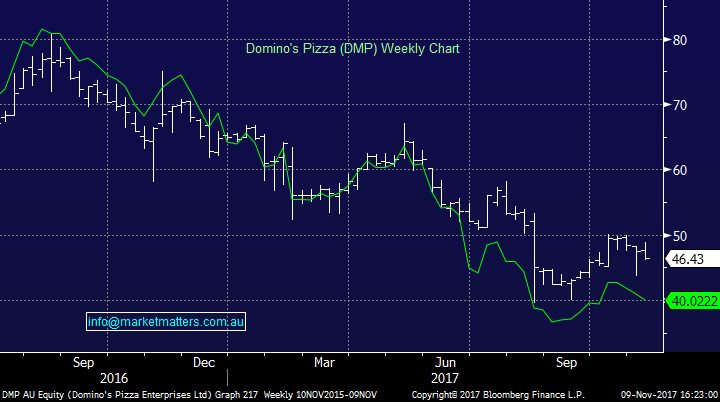

Another notable AGM this week was held by Domino’s (DMP). DMP was once a standout in the market, reaching a lofty $80 last year after pushing an aggressive growth and innovation story – I thought I would be getting pizza delivered by drone by now! DMP missed guidance despite profit growth at 29%, and has struggle since yesterday announcing a forecasted 20% growth for FY18, clearly not living up to investor expectations. DMP must meet high growth targets to justify its PE of 40x.

Domino’s Pizza (DMP) Weekly Chart vs DMP trailing PE

Building material supplier, James Hardie (JHX), posted a trading update on the first half of their 2018 fiscal year that ended in September, and despite a fall in profits and outlook being ‘somewhat uncertain,’ JHX jumped 7.6% to $20.39. The move today is even more surprising given there are doubts around the acquisition of German firm Fermacell announced yesterday and it’s ability to help James Hardie access the European market. Clearly some in the market liked it, pushing JHX to a 6 month high.

James Hardie (JHX) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 9/11/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here